Market Update: Uncertainty Looms Ahead of FOMC Meeting, Top Stocks to Watch for Tomorrow's Trading

For Paid Readers

Traders,

Remaining calm is the hallmark of a successful trader. While chaos reigns on social media, it's important to remember that following the herd rarely leads to extraordinary results. To succeed, you must be poised and level-headed. Emotions have no place in trading.

Traders with a system can weather market volatility by trusting in their edge. Those without a system are more likely to be swayed by emotional swings that negatively impact their trading.

This week, the market has demonstrated strength, with the S&P 500's resilience confirming its strength. While the banking industry has taken a hit, much of the selling appears to be driven by fear rather than valid fundamental reasons after my discussions with numerous top Wall Street executives.

In this report, we'll take a closer look at stocks and identify potential trades for tomorrows trading session.

For market sentiment and breadth analysis, as well as an interview with Roberto, who is known for achieving 1000% returns on options trades, please refer to our Sunday report.

You can find Sunday content here: 1000%+ Options Trader INTERVIEW, S&P 500 Analysis, Market Thoughts.. (substack.com)

Before we get into discussing a few stocks I am watching tomorrow I want to let you know that the PPI data comes out tomorrow and that could impact the market.

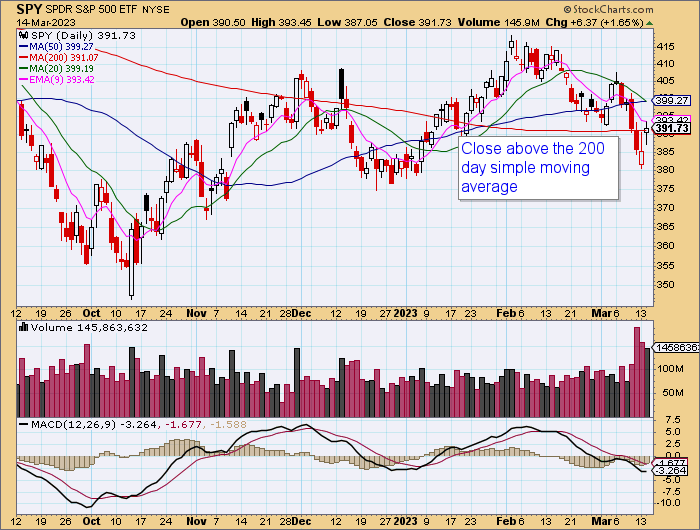

Current State Of The Market

Today, the S&P 500 closed above its 200-day simple moving average, however, it still appears to be a market that is better suited for short-term trades. Given the current risk management considerations, our approach is to focus on 1-2 day swing trades or day trades until the conditions become healthier.

The technical indicators for the S&P 500 are quite volatile and we would like to see the price rise above the 9ema and 20sma to increase our confidence in the market. Unfortunately, this is not the case at this time.

Until the price returns above the 9ema and 20sma, the market remains a higher risk environment for traders. Therefore, we believe it is prudent to participate in lower risk trades for the time being, allowing us to manage risk vs. reward in a more organized manner.