1000%+ Options Trader INTERVIEW, S&P 500 Analysis, Market Thoughts..

Best Selling Publication On Substack

💥What an eventful week it has been in the stock market!

As we gear up for the coming week, we are thrilled to announce a special guest in today's report. He is renowned for his exceptional success in the options world, with returns of over 1000% on his trades!

Our guest will be answering eight questions for our readers, offering valuable insights into his strategies:

How do you identify high-potential options that yield 100-1000% returns?

What key factors do you consider when evaluating options?

What contracts are currently on your radar?

How do you plan to navigate market volatility in the upcoming week?

How long do you typically hold your contracts, and when do you decide to take profits?

Do you typically purchase in-the-money or out-of-the-money options?

Do you prefer weekly expiration contracts or contracts further out?

What advice do you have for novice options traders?

We hope that our readers find this Q&A session informative and insightful.

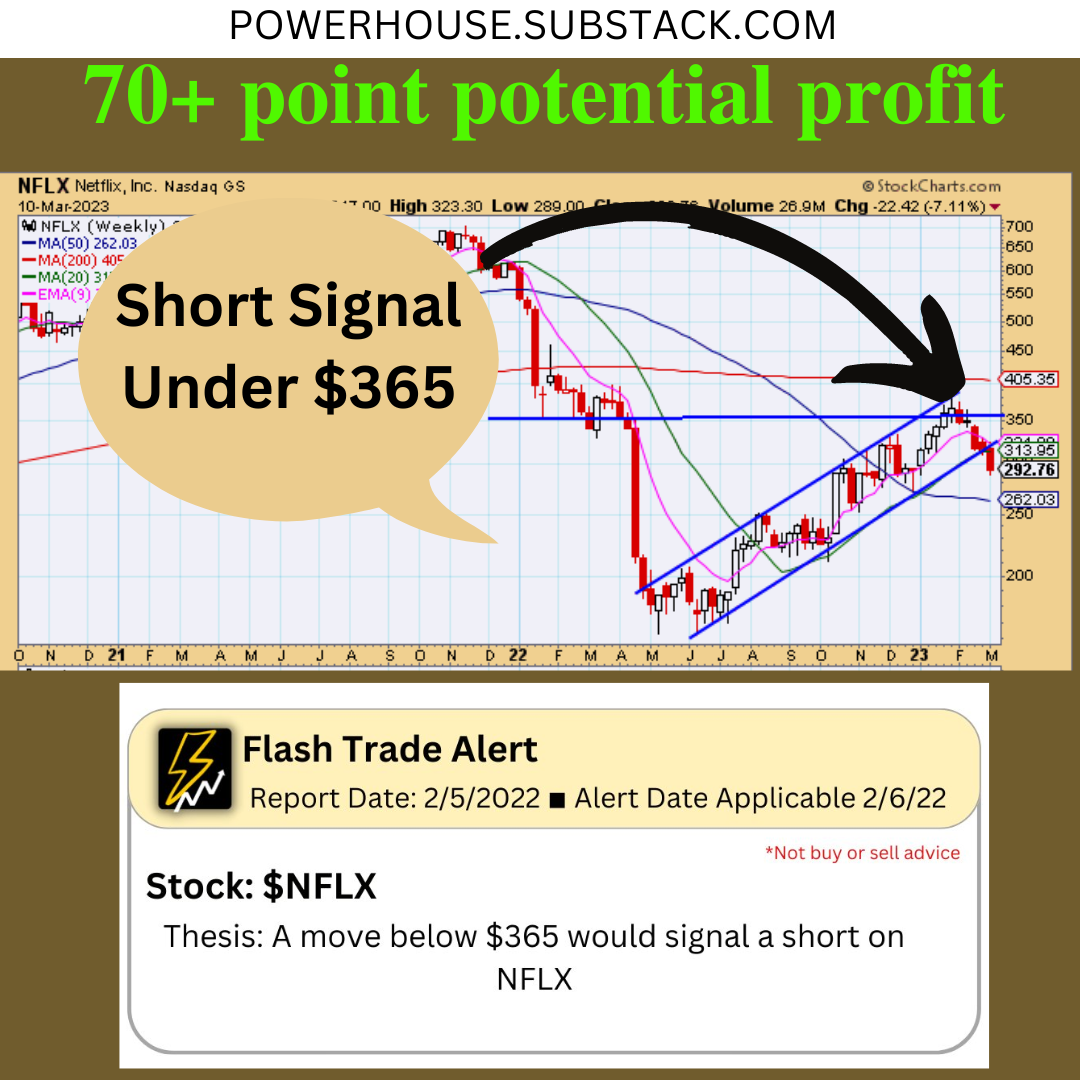

I want to issue a congratulations for those who nailed our flash trade alert on NFLX 0.00%↑ for potential for 70+ point profits!

This upcoming week is going to be unlike any other, as it will be driven by news events that could have a significant impact on the market.

The FED and White House's comments on the 2% inflation target will be critical. If they reiterate their stance on this target, we may see a sell-off in the stock market. However, if the FED changes its tone, we could witness a surge in stock prices.

It is difficult to predict how the market will react, as everyone is eagerly anticipating these comments.

However, I must emphasize that if the FED sticks to their 2% target in the aftermath of a bank collapse, the market may lose trust in the FED, potentially triggering panic among investors.

Two headlines developing currently:

FED RATE CUTS IN 2023 PRICED BACK IN AS BANK WORRIES ESCALATE; FFR PRICED TO BE BELOW 5% BY YEAR END

FEDERAL RESERVE TO HOLD EXPEDITED CLOSED BOARD MEETING ON MARCH 13, 2023 AT 11:30 AM EST

In this report we will discuss:

Market breadth Analysis

We will analyze the market breadth reflecting on key charts and analyzing the S&P 500 to determine a general thesis from a technical perspective.

Our Deluxe Stocks (handpicked)

We stress the importance of our high-quality high growth stocks during this volatile time.

Special Guest Answering 8 Questions

We pride ourselves on delivering reports of the highest quality and strive to maintain our reputation for doing so. We aim to produce reports that are concise and filled with meaningful insights, avoiding superfluous language.

Given the current lack of conviction in the markets leading up to Monday, we have decided to keep today's report brief. We plan to provide more comprehensive commentary on Tuesday after we hear from FED officials and the White House.

Without further ado, let's delve into our report!

Segment 1

Market Breadth Analysis

In this segment, we will examine multiple charts to assess overbought and oversold conditions. Over the past few weeks, we observed an excessive number of overbought conditions. However, following the recent sell-off, have these conditions improved and become healthier?

Let's dive into it...