Hey Guys/Gals,

I made a quick 9-minute video talking about a stock we found of interest at the current levels after analyzing its balance sheet, market position, chart, and future forecast.

We hope this video provides value to you as it never hurts to have us do the extra Due Diligence for you.

If you are not on our paid reports, we are offering a [Time Sensitive] Free 7-Day Trial.

More context on the stock can be found in the article written below.

Shares of Qualtrics International [NASDAQ: XM] announced better-than-expected earnings for the third quarter and as a result, the stock price is trading in the green.

XM became listed on the NASDAQ in January of 2021 so if you have never heard of it then that is why.

“Qualtrics International Inc. operates an experience management platform to manage customer, employee, product, and brand experiences worldwide.”-Yahoo Finance

The company reported massive beats for the quarter:

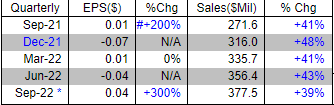

They reported earnings per share for the quarter of $0.04 which beat analyst expectations of -0.02.

This was a +300% growth on a year-over-year basis for the quarterly EPS.

They reported +377.5MIL in sales for the quarter which beat analyst expectations of +358.6M.

This was a +39% growth on a year-over-year basis for the quarterly sales.

For the last 5 quarters XM has achieved over 39% growth in sales!

The company’s annual EPS is expected to turn positive after many years of negative annual EPS. This shows us that the company is starting to gain momentum.

On the earnings call the CEO stated, “Coming off of this strong quarter, we are raising our revenue guidance for our fiscal year to $1.451 billion at the midpoint.”

This is HUGE because a company raising its guidance in this current macro environment shows CONFIDENCE and investors like CONFIDENCE!

The CEO also said on the earnings call that their operating margins increased for the 3rd quarter in a row.

“Our Q3 non-GAAP operating margin rose to 6%, up 400 basis points from Q2. This is our third consecutive quarter of operating margin improvement. We have been investing with discipline as we continue to deliver top-line growth.”-Zig Serafin, CEO

The company has delivered this quarter. They are looking towards the future with goals of continuing ‘top-line growth.

Recession Proof?

XM is an interesting company given the current economic conditions. I say this because companies around the world are focused on maintaining customers. They simply cannot afford to lose clients and therefore companies will invest to make sure their customer experiences are great.

The CEO said this on the call which really shows me that XM has a place of interest for investors, “They are all [companies around the world] focused on making the right investments across their business to win in this downturn. They cannot afford customer churn or low employee productivity, knowing what matters most to their customers and employees is mission-critical.”

“I mentioned before that companies can’t afford to make the wrong decision right now. They have to be right and we have been innovating to unlock data across our platform to help our customers make smarter decisions across their business.”

Guidance

As I wrote earlier, the company had increased its guidance which was impressive but, take a look at what the CFO, Rob Bachman had to say on the company’s earnings call.

We expect total revenue for the fourth quarter to be $380 million to $382 million, representing 21% growth year-over-year at the midpoint. Within this, we expect subscription revenue to be in the range of $323 million to $325 million, representing 25% growth year-over-year at the midpoint. We expect non-GAAP operating margin in the range of 5.5% to 6.5% and non-GAAP net income per share of $0.02 to $0.03, assuming 595 million weighted shares outstanding.

For the fiscal year 2022, we expect total revenue in the range of $1.45 billion to $1.452 billion and subscription revenue in the range of $1.219 billion to $1.221 billion. At the midpoint of the ranges, this represents a subscription revenue growth of 40% year-over-year and a total revenue growth of 35% year-over-year, respectively. We expect non-GAAP operating margin of 4% as implied by our Q4 guide. We expect a non-GAAP net income per share between $0.04 and $0.05, assuming 590 million weighted shares outstanding.

The Chart

XM has been trading sideways for about 6 weeks now between a range of around $10-$11.30.

Above $11.50 could be an area of confirmation of an increase in demand.

The Bottom Line

The bottom line is this is a stock down nearly 70% on the year to date but, has 0 debt and over 700Mil in cash. The company is used by many companies such as Amazon and other well-known companies and has a customer retention rate of 124%.

In today’s world being able to give the consumer the best experience is essential and that is where XM steps in to provide the best experience possible for not only the consumer but, the employees as well.

This company is unique and has minimal competition for market share and has full pricing power in this market.

For more trade and investing ideas please subscribe to our newsletter.

DISCLAIMER: Lusso’s News LLC offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at Lusso’s News, LLC on a written article, post, newsletter or comment, you agree to hold Lussosnews.Com liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lossed at any time. Lusso’s News, LLC never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at Lusso’s News, LLC may be buying or selling any stock mentioned at any given time. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Lusso’s News, LLC Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Lusso’s News, LLC recommends you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk-free” industry. If you do agree to this, then please exit our website now. LUSSO’S NEWS, LLC IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, Lusso’s News, LLC nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education. THE ABOVE POWERHOUSE REPORT INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND DISCLAIMER. OUR REPORT IS FOR INFORMATION PURPOSES ONLY AND IS NOT BUY OR SELL INVESTMENT OR TRADE ADVICE. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED AND FULL RISK APPLIES OF LOSING MONEY ON A TRADE. OUR WRITERS AND TRADERS ARE NOT LICENSED OR FINANCIAL ADVISORS.

WATCH: Presenting A Stock Pick With 9 Minute Video