This Company Reported Earnings Today +19% On the YTD

Earnings Recap On A 2022 High Performing Stock

Good morning and CONGRATULATIONS Traders and Investors,

BJ’s wholesale Club [NYSE: BJ 0.00%↑ ] is one of our MOST FEATURED stocks of 2022 as we have started to cover this early this year.

The stock is trading up nearly 20% on the year to date which is outperforming the S&P 500 which is down -17% on the year to date.

As BJ has been a rockstar addition to a portfolio for swing traders, the company reported EARNINGS TODAY and the stock has touched new highs in the pre-market session.

***We did not review the earnings call yet as it is being conducted now. The stock is lower in the opening sessions but, the $69-$70 area is of interest. ***

I Always Tell My Readers…

I always tell my readers that if you catch a few 20% winners a years, a few 40% winners and maybe 1 or 2 100% winners a year with losses averaging less than 5% then you are sitting up VERY NICE on the year in your portfolio!

Now…lets discuss the earnings on BJ 0.00%↑ for everyone.

EARNINGS

Here are the highlights directly from $BJ’s investors page for the Q3 results⬇

Third Quarter Fiscal 2022 Highlights

Total comparable club sales increased by 9.7% year-over-year.

Comparable club sales, excluding gasoline sales, increased by 5.3% year-over-year.

Membership fee income increased by 8.7% year-over-year to $99.5 million.

Digitally enabled sales growth was 43.0% year-over-year.

Earnings per diluted share of $0.95 reflects a 3.3% year-over-year increase.

Adjusted earnings per diluted share of $0.99 reflects a 8.8% year-over-year increase.

Cash from operating activities was $173.1 million and free cash flow was $78.7 million.

The Company opened three new clubs in the third quarter.

…………

I have always made the case that membership stores with bulk items such as Sams club, Costco and BJ’s are to some extent recession proof.

The income class that shops at these stores is higher with a company like COST 0.00%↑ seeing the average household making 100k while Walmart has the average household making less than $50k.

BJ 0.00%↑ offers gas at a cheaper price for members than your regular gas station which continues to attract demand as the companies' memberships continue to grow!

“Our member base is growing in both size and quality,” Bob Eddy, President and Chief Executive Officer, BJ’s Wholesale Club.

RAISED GUIDANCE

As companies continue to cut their Q4 forecast, BJ raised their guidance on the top and bottom line.

Read what they had to say in their investor press release⬇

Fiscal 2022 Ending January 28, 2023 Outlook

“We are optimistic about the outlook on our business given the sustained strength in our grocery business and our gains in market share,” said Laura Felice, Executive Vice President, Chief Financial Officer, BJ's Wholesale Club. “We now expect fiscal year 2022 comparable club sales growth, excluding the impact of gasoline sales, to be in the 5.0% to 5.5% range. While we expect continued merchandise margin rate pressure, we also now expect fiscal year 2022 EPS to be in the $3.70 to $3.80 range. We remain confident that the strength of our core business and our intense focus on delivering value will continue to drive long-term growth.”

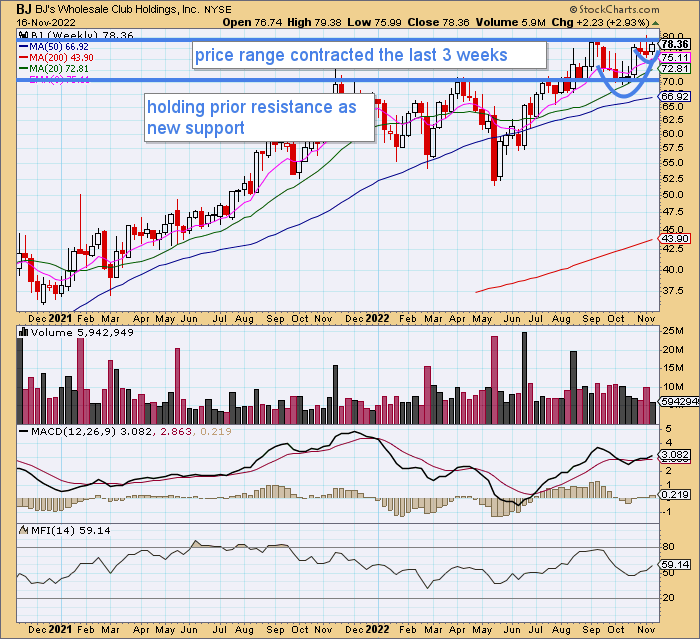

The Chart

The $70 area is the key area for this stock as it is PRIOR RESISTANCE which has acted as NEW SUPPORT.

*****The company is having their earnings call this morning which we have not reviewed yet!****

Previously On Lusso’s News Insider

Read our last earnings coverage on BJ 0.00%↑ .

RARE STOCK, Great Earnings + Great Technicals (substack.com)

DISCLAIMER: Lusso’s News LLC offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at Lusso’s News, LLC on a written article, post, newsletter or comment, you agree to hold Lussosnews.Com liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lossed at any time. Lusso’s News, LLC never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at Lusso’s News, LLC may be buying or selling any stock mentioned at any given time. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Lusso’s News, LLC Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Lusso’s News, LLC recommends you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk-free” industry. If you do agree to this, then please exit our website now. No Refunds at any time.LUSSO’S NEWS, LLC IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, Lusso’s News, LLC nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education. THE ABOVE POWERHOUSE REPORT INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND DISCLAIMER. OUR REPORT IS FOR INFORMATION PURPOSES ONLY AND IS NOT BUY OR SELL INVESTMENT OR TRADE ADVICE. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED AND FULL RISK APPLIES OF LOSING MONEY ON A TRADE. OUR WRITERS AND TRADERS ARE NOT LICENSED OR FINANCIAL ADVISORs