Hello Traders,

I want to reflect on why the market bounced and how you can use this as a potential lesson for next time if you did miss this bounce.

The way I view charts is I read charts from a psychological viewpoint. It is almost like a mathematical formal I suppose.

I alerted our paid subscribers of this bounce on Sunday evening with a key emphasis on the $360 area.

Make sure to get on our paid reports. We are focused on quality only.

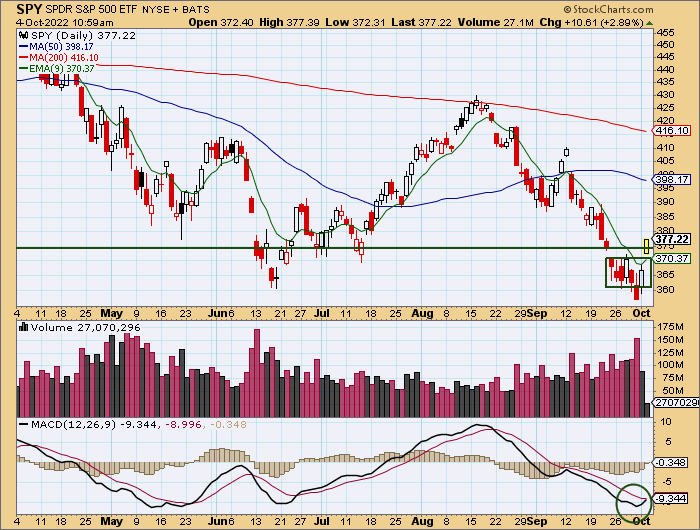

As you can see, Fridays price action broke down below support on high volume.

One thing you must realize from a psychological standpoint is that anytime a stock breaks out or breaks down below a key support/resistance level, it opens the door for a ‘trap’.

What does this mean?

For example, the SPY broke down below $360 on Friday which caused a few events to trigger:

Weak hands got shaken out

Short sellers shorted more

If the SPY reversed back over $360, then it will have ‘trapped’ the short sellers who took positions Friday, and it could cause weak hands that got shaken out Friday to buy back.

This is why failed breakouts/breakdowns are usually meant with strong reversals because of short covering and weak hands buying back their positions.

Now, going into Monday we knew:

The technical conditions were oversold.

$360 was a key area because it was a prior support area and a potential ‘double bottom area’.

Now, predicting the psychological behavior of traders, we were able to conclude that:

If the price of SPY 0.00%↑ reclaimed $360 then the 'double bottom' narrative is still in the cards.

Over $360, short sellers would be pressured to cover (creating more demand)

Over $360, the weak hands that sold Friday will probably look to get long again (creating more demand)

As a result, the probabilities for a bounce were raised if the price crossed over $360.

Now, there are other events that helped raise our conviction such as a new month.

Historically, September is a bad month for the markets and Monday was the first day of the new month.

Reading Charts…

It is easy to draw lines on charts but, to be a great chart reader you need to be able to tell a story.

I challenge each and every one of you to really tell a story.

For example:

Stock X is at support.

Instead of saying, “I am going to buy it because it is at support”

You should think:

“The stock is at support. If this breaks the support line then it could shake out weak hands and cause more short sellers to come in. As a result, if it returns back over support then I could look to get long because shorts may need to cover and more demand could flush into the stock because the failure to breakdown shows exhaustion from bears and once bulls see that, they will start buying”

You see, how my thesis was all about the potential action of other traders?

Technicals don’t move prices, buyers and sellers move price!

So find reasons and tell a story why buyers and sellers will move price in this area other than being lazy and saying, “it is at support”.

I hope everyone enjoyed this quick read.

For more, make sure to get on our paid reports.

Ciao

DISCLAIMER: Lusso’s News LLC offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at Lusso’s News, LLC on a written article, post, newsletter or comment, you agree to hold Lussosnews.Com liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lossed at any time. Lusso’s News, LLC never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at Lusso’s News, LLC may be buying or selling any stock mentioned at any given time. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Lusso’s News, LLC Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Lusso’s News, LLC recommends you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk-free” industry. If you do agree to this, then please exit our website now. No Refunds at any time.LUSSO’S NEWS, LLC IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, Lusso’s News, LLC nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education. THE ABOVE POWERHOUSE REPORT INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND DISCLAIMER. OUR REPORT IS FOR INFORMATION PURPOSES ONLY AND IS NOT BUY OR SELL INVESTMENT OR TRADE ADVICE. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED AND FULL RISK APPLIES OF LOSING MONEY ON A TRADE. OUR WRITERS AND TRADERS ARE NOT LICENSED OR FINANCIAL ADVISORS.