Good morning, make sure to read Part 1 of our report which was sent out last night.

Part 1 featured 3 Golden Ticket Trades, so make sure to look it over as it is more specific.

Futures are trading higher with the S&P 500 up +1.77%, the NASDAQ 100 up +1.78%, and the Dow Jones (DJIA) up+1.52%.

I DO THINK WE SEE A NICE RANGE TO TRADE AROUND THIS WEEK!

BE PREPARED!

The S&P 500 did crash the past few sessions then came to equilibrium as the chart shows below.

The Scenario:

Bullish Scenario: The S&P 500 goes straight to $3800 which is prior resistance, a move over $3,800 would be seen as a breakout and could be a start of a multi-day rally as shorts would look to cover over $3,800 in our opinion

Bearish Scenario: The trend is your friend and we are still in a downtrend with poor macro conditions. IF the S&P 500 cannot get above $3750 and it does trade back below $3,700 then that would be worrisome and cause panic selling and a potential next leg lower in our opinion.

Levels:

Above $3,800 is bullish

Above $3,750 is bullish intraday

Below $3,700 is bearish

Between $3,700-$3,750 is good scalping ranges

$SPY

The $SPY has a large gap to fill around $388 and this is on high alert for a potential gap fill if a rally is in the cards!

NOTE: DO NOT ANTICIPATE BUT, REACT! Have scenarios in each direction to trade around and hold no bias! As a trader, it shouldn’t matter what direction it goes as long as it is moving and there is a range!

GAMEPLAN: When we get large gap ups after an extended weekend I prefer to sit back the first 30 minutes and just watch. Let the algos, FOMO buyers do their thing the first 30 minutes and then see how the market acts and trade according.

A green to red move would be VERY BEARISH and you do not want to get caught in a morning sell-off.

Wildcard Watch

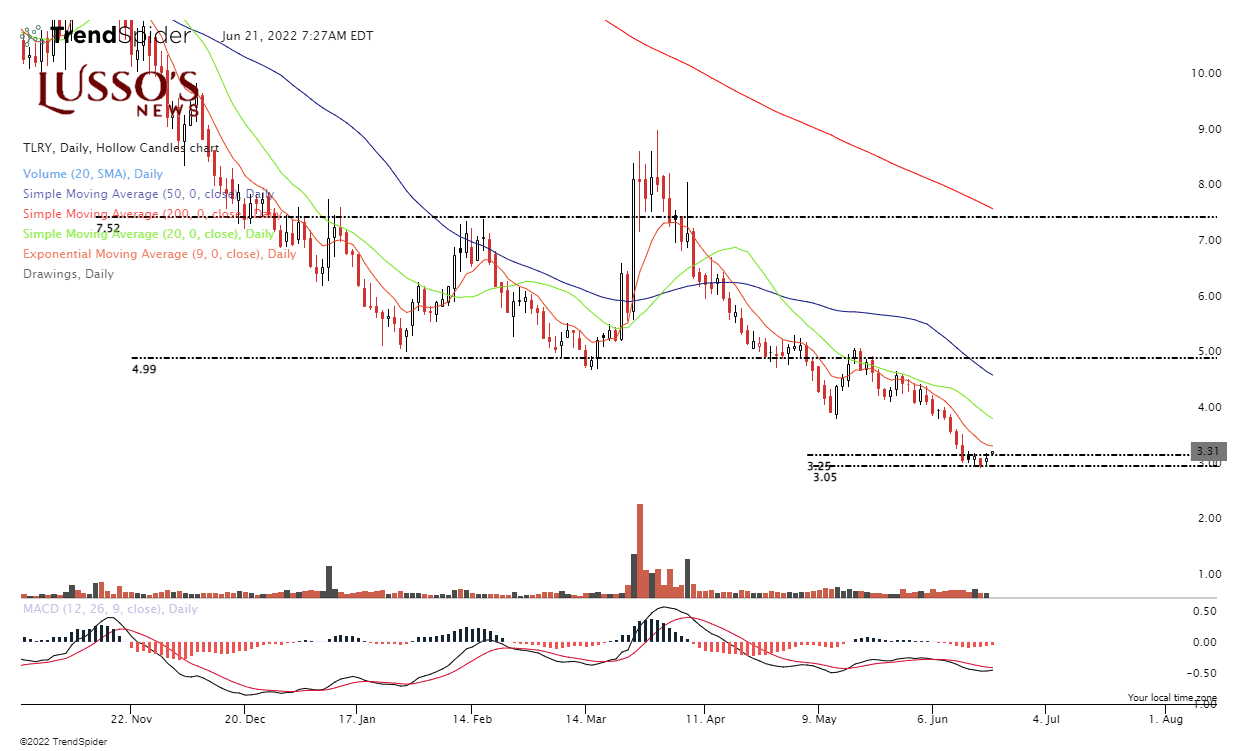

TLRY is worth the watch here. The cannabis industry is HUGE! I have worked hand and hand with the CFO of one of the largest cannabis companies, helping them with their finances and I was very impressed with the amount of money they were seeing each month!

As you can see on the bottom right of the TLRY daily chart, it has fallen sharply from $4 but, has reached a consolidating range from $3.05-$3.25. This morning it is gapping up over that range.

MY GUES: My guess is that the left pushes hard for national legalization for this industry since they have a few things to run on for midterms coming up. Cannabis stocks are on high alert for swing traders.

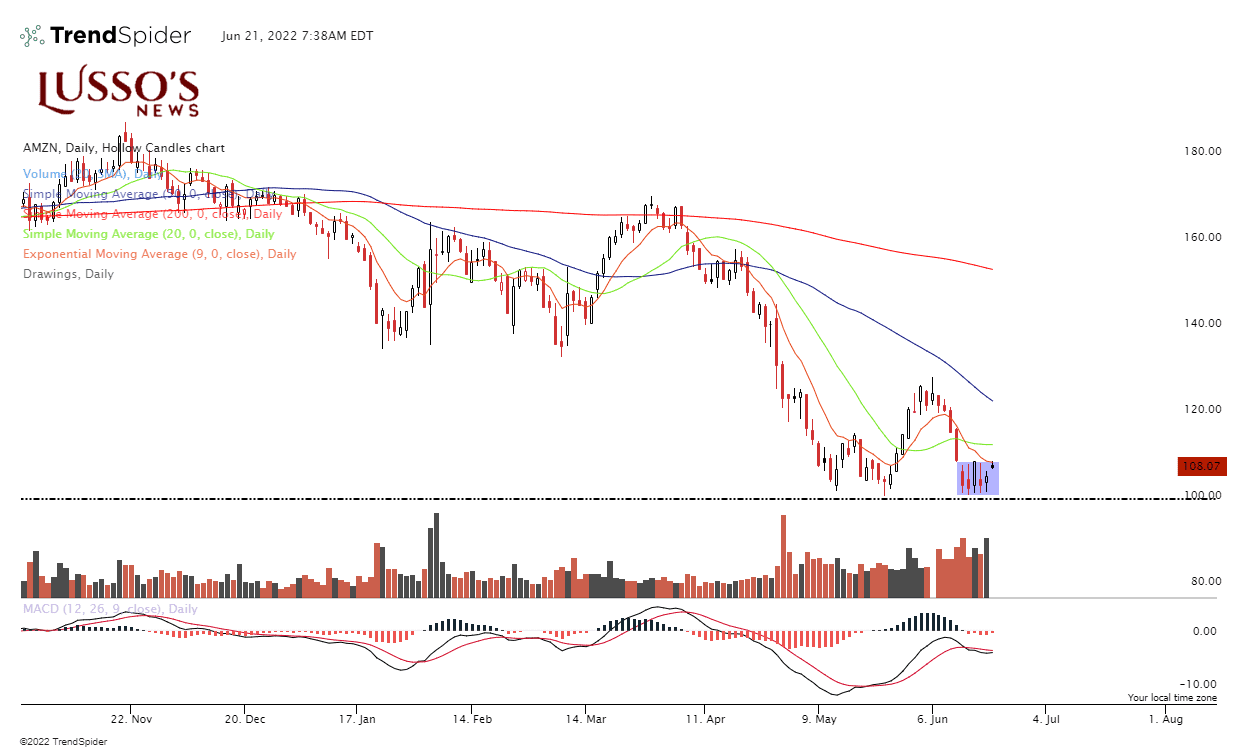

If the market does rally then $AMZN will be an active stock among traders. Whether in the options market or trading the equity, AMZN could be appealing if it did triple bottom around $100 which appears to be the case…for now.

A move back to $120 is in the cards if markets do rally.

ARKK

ARKK has the worst investment process. They buy stocks that do not generate positive EBTIDA and they buy them at crazy valuations…

With this being said, many of these stocks are oversold and ARKK has traded sideways for around a month now.

A test of $45 is in the cards and over $45 could be seen as a breakout.

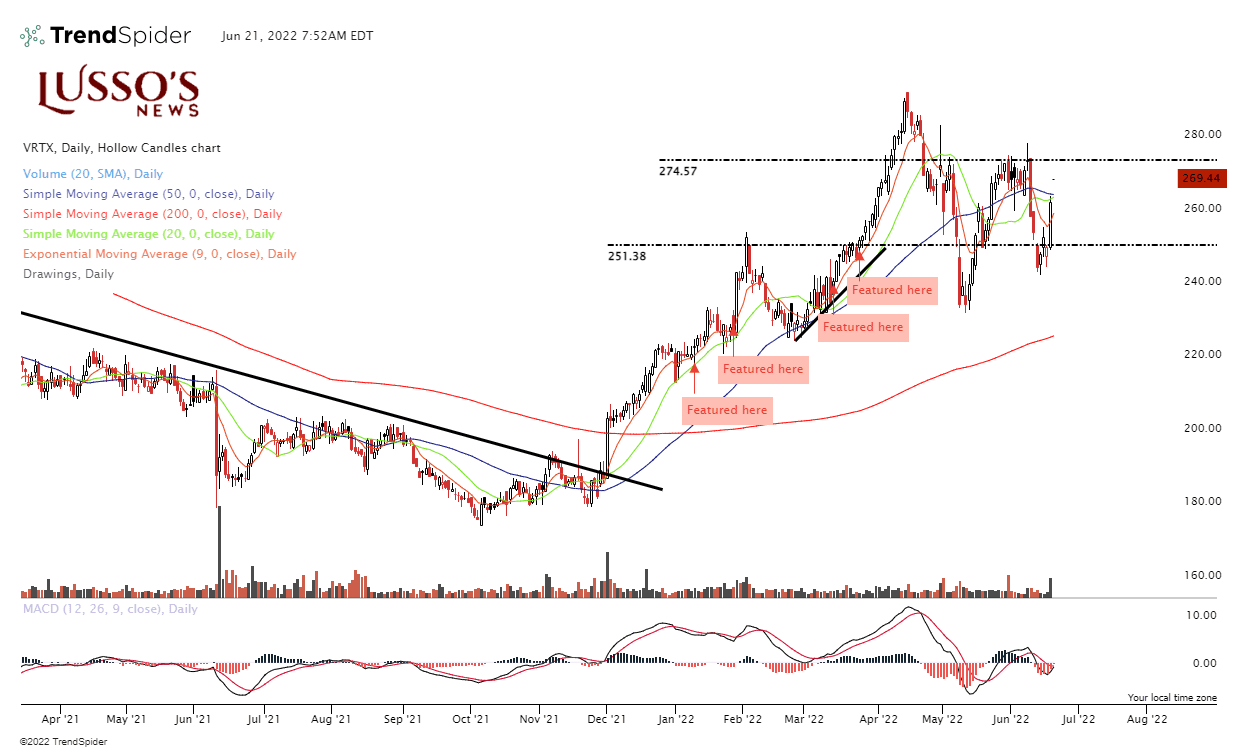

VRTX

VRTX is a stock we have featured numerous times and over $274 is on high alert for a potential next leg up.