Markets tend to crash based on unexpected events.

If CPI data comes in higher month over month, will this be an unexpected event?

In this publication we will go over:

The 10 Year Treasury Yield

US Dollar

Technical Developments On The SPY 0.00%↑

Thoughts On The FED Pivoting

Beware Of Fintwit

We value all of our readers but, want to give a quick shoutout to our exclusive readers.

For more info on our paid newsletters, visit here.

As I told our exclusive readers on Sunday:

The daily MACD bearishly converged for the first time since this rally began from the lows.

Price fell below the 9EMA for the first time since this rally began.

This is significant because it shows from a technical perspective that momentum is to the downside in the near term.

Everyone thinks inflation has peaked and frankly if CPI data comes in higher on a month-over-month basis the Financial Markets could be looking at a recipe for a crash.

Lets review some concerns…

There is a concern with Oil going higher. I personally believe higher oil prices put more pressure on inflation as, the cost of shipping rises=prices rise to maintain profit margins.

Grains (corn, wheat, soybeans) all appeared to have bottomed in the near term and are moving higher as well.

Covid could spark higher in Asia this Fall/Winter which could cause lockdowns=Supply chain issues potentially

Geopolitical tensions are high

Dollar is strong

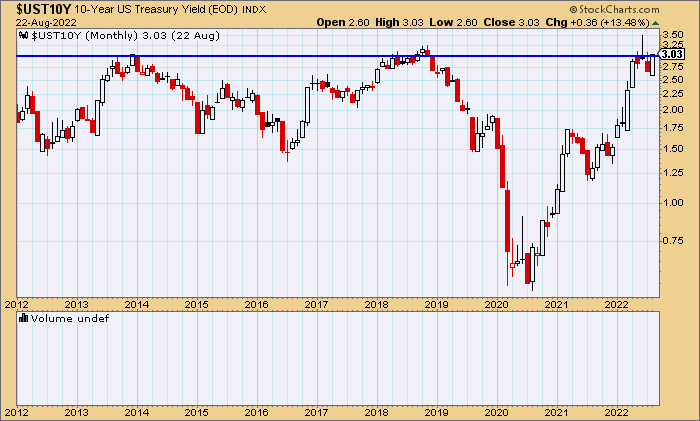

Yields are rising

Simply put, we are NOT out of the gutter in my opinion and it is VERY POSSIBLE that the market has not priced in the full rate hikes as it may take more hikes to get inflation under control.

WE JUST DO NOT KNOW…

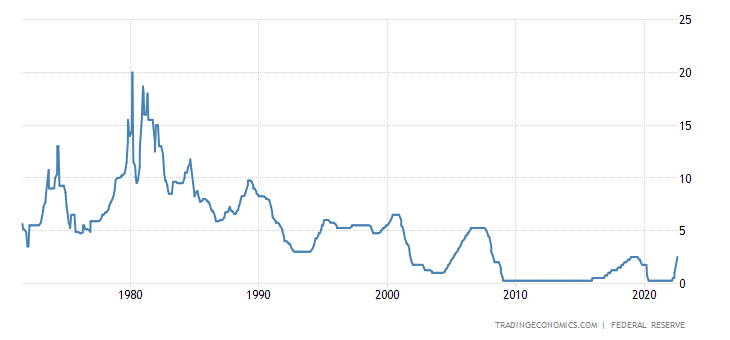

The FED Will NOT Pivot…

My opinion is the FED will not pivot. If unemployment numbers rise, the FED will most likely be more encouraged to move faster and more aggressively so they are not stuck in a stagflation environment. Markets tend to think the FED will pivot and I beg to differ.

Inflation is WAY TOO HIGH and it will take a consistent aggressive Federal Reserve to get this under control.

There is no telling how high rates will go.

Looking at prior history we can be in for a volatile ride and the next 1-2 years could be an ugly environment for stocks.

From my understanding, the FED will do whatever it takes to get inflation under control and we just do not have enough data to say…it has peaked.

If inflation has peaked then why are the 10-year treasury yields nearing a…potential breakout???

If Inflation has peaked and the market has already priced in the Federal Reserve’s actions then why is the US Dollar Index breaking out MASSIVE to levels not seen since the….early 2000’s?

BE CAREFUL….

When you see a trader on Twitter that is only posting data that is bullish but, they are also LONG…they have directional bias and you want to be careful of the data and information they provide because you DO NOT want to be influenced by their bias.

The way we operate is, that we look at the information in front of us and we come up with a solid thesis that can be turned into a high-conviction trade plan.

We do not want to have a directional bias, we want to remain very open-minded and ask ourselves, “ How do I know I am right"?”

Guys…Gals, we are offering 20% off for LIFE on your premium publications. Check it out here for more info

The Bottom Line

The bottom line is we do not have enough information to have a strong conviction to the upside. We want to see what the next CPI Data release numbers look like before we have a longer-term view.

After one month of flattened (not decreasing) CPI, everyone is celebrating…Inflation is still very high and we have not seen multiple months of decreasing CPI data.

We have only seen…talking heads…talk.

DISCLAIMER: Lusso’s News LLC offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at Lusso’s News, LLC on a written article, post, newsletter or comment, you agree to hold Lussosnews.Com liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lossed at any time. Lusso’s News, LLC never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at Lusso’s News, LLC may be buying or selling any stock mentioned at any given time. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Lusso’s News, LLC Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Lusso’s News, LLC recommends you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk-free” industry. If you do agree to this, then please exit our website now. No Refunds at any time.LUSSO’S NEWS, LLC IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, Lusso’s News, LLC nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education. THE ABOVE POWERHOUSE REPORT INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND DISCLAIMER. OUR REPORT IS FOR INFORMATION PURPOSES ONLY AND IS NOT BUY OR SELL INVESTMENT OR TRADE ADVICE. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED AND FULL RISK APPLIES OF LOSING MONEY ON A TRADE. OUR WRITERS AND TRADERS ARE NOT LICENSED OR FINANCIAL ADVISORS.

Great analysis and thesis gentlemen- please keep it coming 👍🏻👍🏻👍🏻