🤯Is It Time To Short Stocks? Top 3 Trading Opportunities Amid a Weakening Dollar

For Paid Readers

Good morning traders,

This week, we look to tighten up our watchlist by concentrating on a select few opportunities instead of spreading our focus too wide. We've identified prospects across various industries, and by focusing in on them, we hope to capture significant upward or downward movements.

Last night, the S&P 500 futures dipped to $4,133, but as of now, they have rebounded and are trading above $4,150. This pattern of starting off weak and then transitioning from red to green has been a recurring theme, further affirming the market's strength.

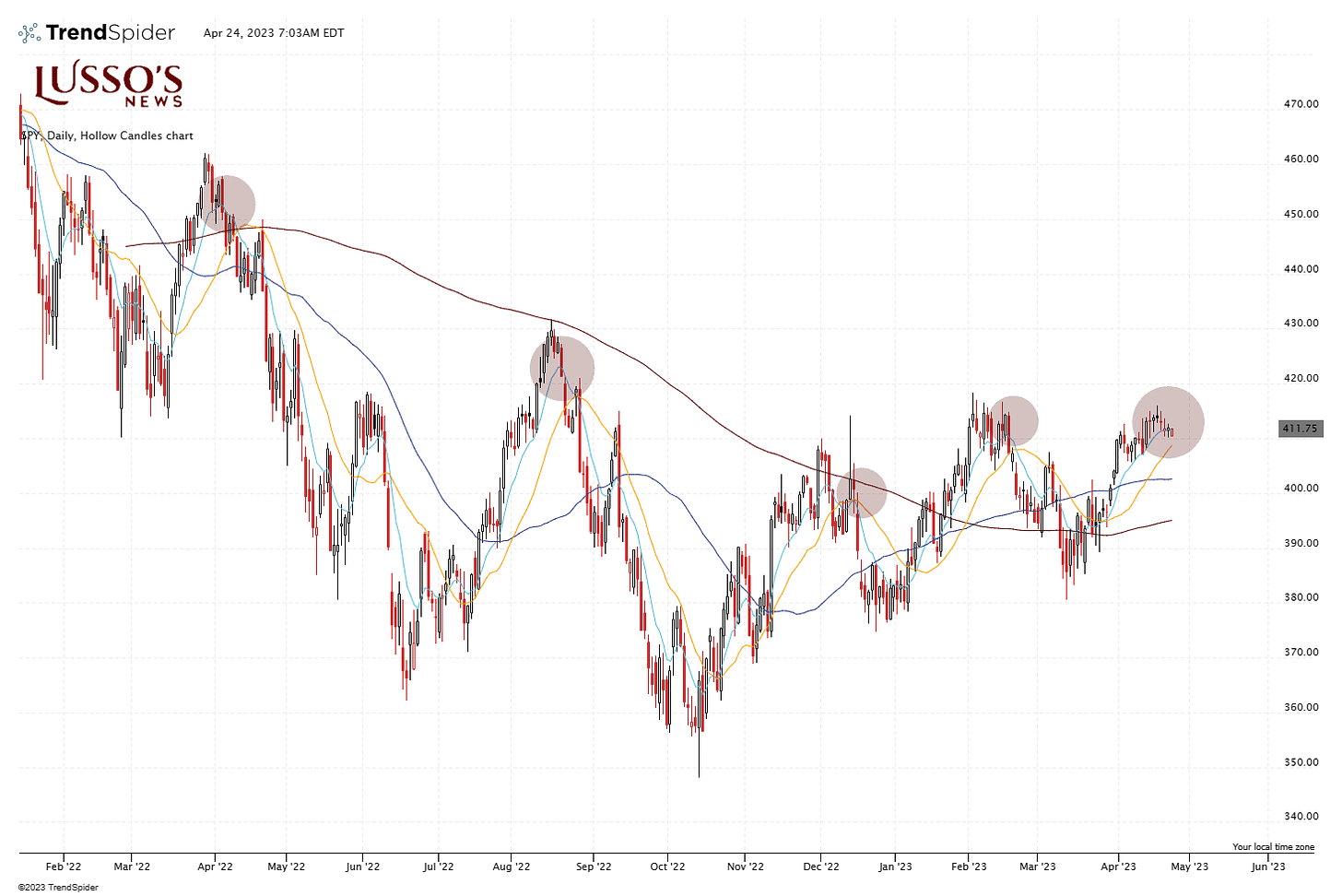

🚨Before diving into our brief report, it's important to notify everyone that the S&P 500 is currently below the 9-day exponential moving average (EMA), which, based on historical data, indicates a bearish sentiment.

This development is significant, as illustrated in the chart below, where the red circles highlight instances when the price trading below the 9-day EMA led to a downtrend.

In this situation, we want to monitor whether the S&P 500 candle closes below the 9-day EMA, as the closing price carries more weight than the opening price.