Explosive Short Squeeze Stocks Unleashed: Uncovering Hidden Gems That Could Skyrocket 🚀

Analyzing the Financial Health, short interest, charts

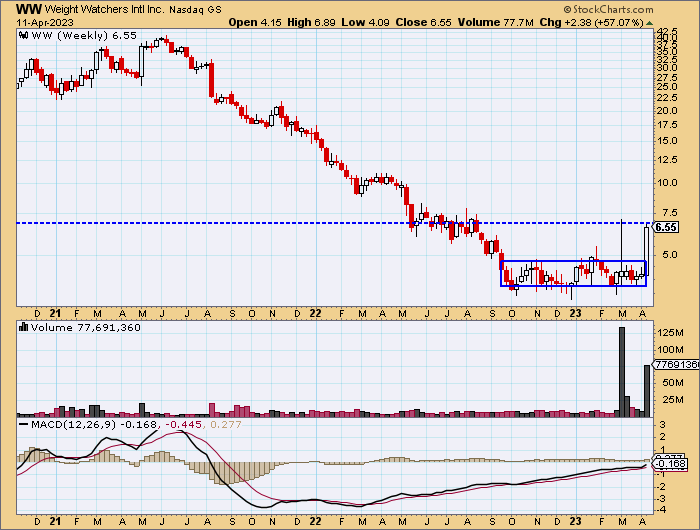

In today's stock market report, we'll be diving into an in-depth analysis of WW International ($WW) as it skyrocketed more than 57% today, with over 70 million shares traded. We'll examine the factors that led to this massive leap, such as the acquisition of telehealth provider Sequence and an upgraded rating by Goldman Sachs analyst Jason English.

However, before we can fully assess the impact of today's news, it's essential to evaluate the company's financial health which we uncover the financials and a gameplan on the stock.

We will also be taking a closer look at a stock that a Wall St veteran told me he thinks he will make 7 figures on this year.

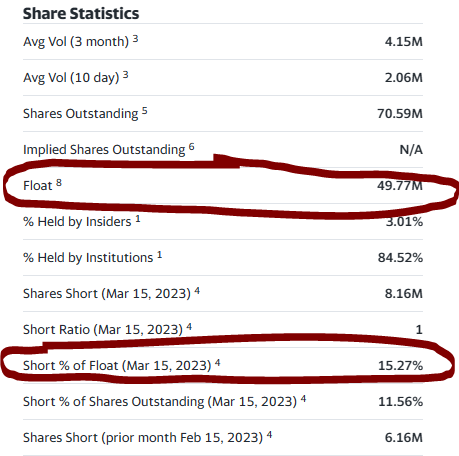

In addition, we have identified several stocks with high short interest that are prime candidates for potential short squeezes which we will share with everyone.

WW 0.00%↑ WW International

Today we saw shares of $WW, close over 57% higher with over 70 million shares traded on the day.

The company did announce news which we will discuss but, first we need to review the companies’ financials.

Lets dive in👇

Financials

The company's financial health seems to be a mixed bag, with some strengths and weaknesses observed in their financial statements.

On the positive side, the company has demonstrated consistent growth in operating revenue over the past four quarters, indicating that its core business operations are expanding. Gross profit also shows a healthy increase in the same period, which could be a sign of improving margins or effective cost management. However, the company has faced challenges in maintaining profitability.

Net income has been negative over the trailing twelve months (TTM), with substantial losses in some quarters. This is primarily due to high operating expenses, non-operating interest income expenses, and significant impairment charges, which have significantly impacted the company's bottom line.

From a liquidity standpoint, the company's working capital has increased in recent quarters, indicating that it has the ability to cover its short-term obligations.

However, the high levels of total debt and net debt could be a cause for concern. In a rising interest rate environment, higher debt servicing costs could further strain the company's finances and put additional pressure on its profitability. Furthermore, the negative stockholders' equity and a decline in tangible book value suggest that the company's financial position is not particularly attractive.

After reviewing the financials, I find that the company has demonstrated some revenue growth and a positive working capital trend, the substantial debt burden and negative net income indicate potential risks and challenges that need to be addressed to ensure long-term financial stability and TODAYS NEWS DOES NOT SOLVE THAT ISSUE.

TODAYS NEWS

The recent news about WW 0.00%↑ acquisition of Sequence, a telehealth provider, has the potential to significantly impact shareholder and investor sentiment towards the stock and that is what we saw today with the stock jumping 59% in share price, combined with Goldman Sachs analyst Jason English's upgraded rating and raised price target, suggests increased confidence in the company's growth prospects.

The integration of a pharmaceutical-based clinical subscription service with WW's traditional behavioral-based weight management offering could create a more comprehensive and attractive product for customers, tapping into the rapidly growing market for obesity drugs but we have to ask ourselves, will this really re-shape the financial health?

However, we should also consider the company's financial health as discussed earlier, which includes concerns such as high debt levels, negative net income, and declining tangible book value.

While the acquisition of Sequence and the potential for a turnaround in the obesity drug market are undoubtedly positive developments, it is essential for us to weigh these factors against the financial risks the company currently faces.

As traders we need to closely monitor how effectively WW International can integrate the newly acquired business, capitalize on the emerging market for weight-loss drugs, and address its existing financial challenges in order to make an informed decision on the stock's future prospects.

Trader Key Points

From a trader perspective I see todays news as a nice positive headline that does nothing to change the financials of the company.

Keep reading with a 7-day free trial

Subscribe to Lusso's News Insider to keep reading this post and get 7 days of free access to the full post archives.