🚨This stock pick is being shared with both our paid and free readers, and while we believe it has potential, it's not one of our top picks. Upgrade to a paid subscription to gain access to the stocks that truly wow us.

Good morning, everyone! As experienced traders, we know that earnings season is a prime time to identify companies with potential for growth. This week, we saw the success of our coverage on $MBLY, which is up 8% since we reported on their earnings.

Today, we're excited to share with you another company that just reported their earnings. All of the earnings coverage stocks we select are carefully chosen to provide the best potential for success.

Dynatrace [NYSE: DT 0.00%↑]

Shares of DT 0.00%↑ are trading higher in the pre-market session almost by 5% higher.

This comes after the company reported their earnings today.

Before I dive into the earnings briefly, I do want to share the important level of the chart.

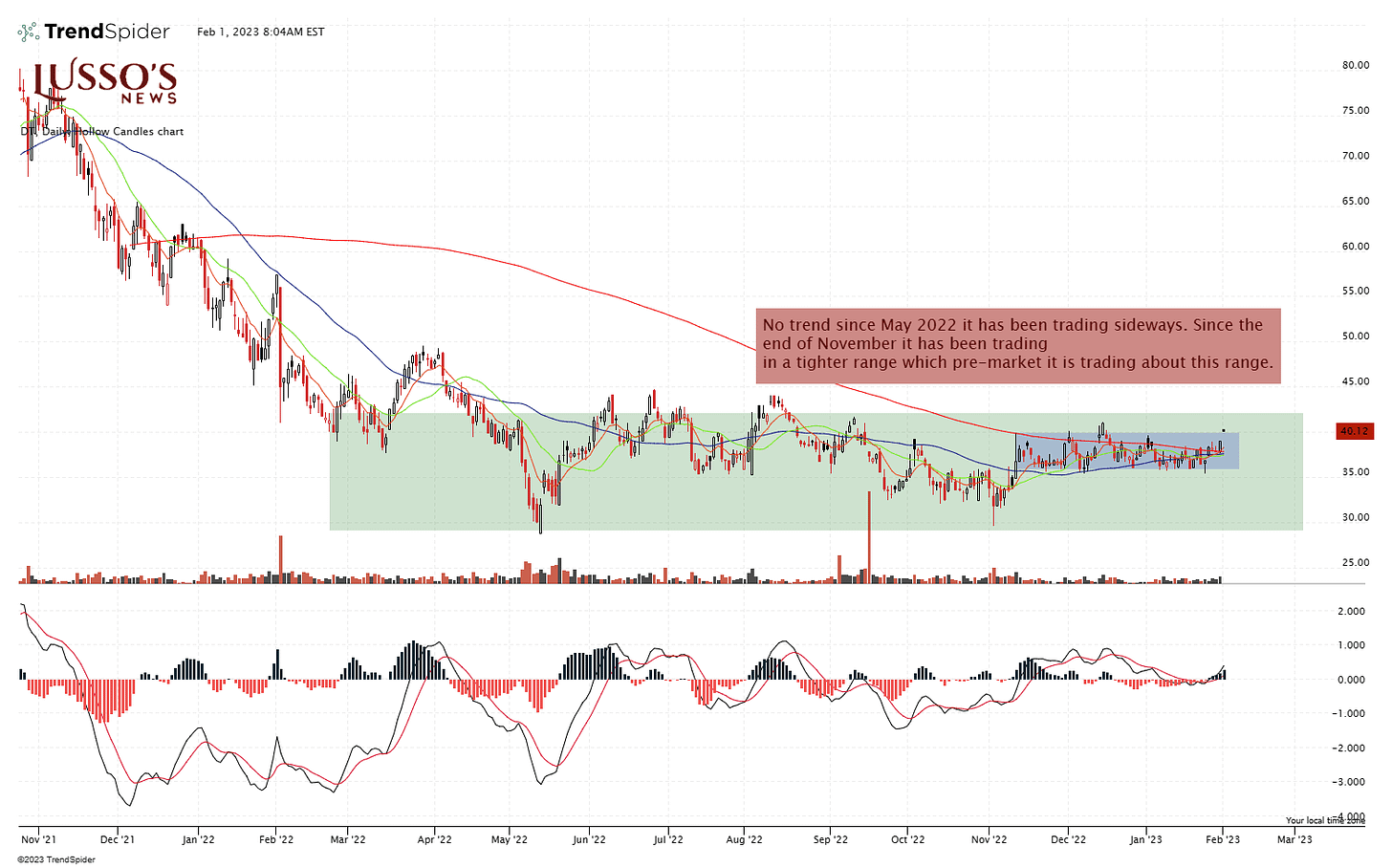

A quick technical review of the chart:

It has been trading sideways in no trend since May of 2022 after a large decline

A breakout above $45 could be see as a very bullish move and according to the Dow Theory it was be seen as the accumulation enter the trend phase.

Nothing is confirmed until a move over $45 occurs.

The Dow Theory consists of three phases:

Accumulation Phase: This phase is characterized by a period of low volatility, during which investors accumulate stocks at lower prices. This phase is usually seen as a sign of a coming bull market.

Trending Phase: In this phase, the market trend becomes established, and the direction of the trend is confirmed. The trend may continue for an extended period, with prices rising or falling consistently in the same direction.

Distribution Phase: This phase is characterized by a period of high volatility, during which investors take profits and the market trend loses momentum. This phase is often seen as a sign of a coming bear market.

Dynatrace, a software intelligence company, reported strong financial results for the third quarter of its fiscal 2023.

Total ARR was $1,163 million, with adjusted ARR growth of 29% YoY

Total revenue was $297 million, up 29% on a constant currency basis.

The company had operating income of $34 million and non-GAAP operating income of $81 million,

The company BEAT ANALYST expectations on the top and bottom line!!!

Bullish comments in the earnings report include CEO Rick McConnell's statement that "the secular tailwinds of digital transformation and particularly cloud modernization are driving an explosion in data, making observability increasingly mandatory across all industries" and that Dynatrace is "focused on driving innovation to meet customers' evolving needs."

The company was named a leader in The Forrester Wave for Artificial Intelligence for IT Operations and a leader in the Gartner Magic Quadrant for Application Performance Monitoring and Observability.

Dynatrace has expanded partnerships with ten Global System Integrators and has seen growth in business transacted through partners including AWS, Google Cloud, and Microsoft. The company has also expanded its platform, adding the Dynatrace Grail data lakehouse for business analytics.

These bullish comments and strong financial results suggest that Dynatrace is well positioned to benefit from the growing demand for digital transformation and cloud modernization, and that the company is effectively executing on its strategic priorities.

Now as traders we need to wait for it to pivot of $45.

The Bottom Line

Guys, the bottom line is yes, this company is worth putting on a watchlist but, it needs to stay over $40 for traders to start gaining confidence. It is very important that stocks have high volume associated with breakout days and this is exactly what we want to see with $DT.

Confirmation of positive developments or expectations regarding a stock can lead to increased demand and drive up its price.

This is because when investors receive confirmation that the stock is performing well, they become more confident in their investment and are more likely to purchase shares. In the case of DT 0.00%↑ over $40 would be a area of rises confirmation but, it is not until the stock pivots over $45 where the real conviction and confirmation will arise!

As demand for the stock increases, so does its price, as more investors compete to purchase a limited number of shares.

Wishing everyone a green day!

Navigating the FOMC Event and Taming the Volatile Markets (substack.com)

DISCLAIMER: Lusso’s News LLC offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at Lusso’s News, LLC on a written article, post, newsletter or comment, you agree to hold Lussosnews.Com liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lossed at any time. Lusso’s News, LLC never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at Lusso’s News, LLC may be buying or selling any stock mentioned at any given time. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Lusso’s News, LLC Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Lusso’s News, LLC recommends you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk-free” industry. If you do agree to this, then please exit our website now. LUSSO’S NEWS, LLC IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, Lusso’s News, LLC nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education. THE ABOVE POWERHOUSE REPORT INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND DISCLAIMER. OUR REPORT IS FOR INFORMATION PURPOSES ONLY AND IS NOT BUY OR SELL INVESTMENT OR TRADE ADVICE. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED AND FULL RISK APPLIES OF LOSING MONEY ON A TRADE. OUR WRITERS AND TRADERS ARE NOT LICENSED OR FINANCIAL ADVISORS.