Hey everyone-

As earnings are released we will be releasing small segments featuring 3 stocks that we felt produced solid growth quarters.

These stocks can and should in our opinion be put on a watchlist.

With this being said, each small segment will feature 3 stocks so this way you do not get bored and you actually read over the entire segment.

We will send another segment out shortly, it takes time to read through the earnings reports and figure out if the stocks meet our fundamental criteria.

Once a stock reaches our fundamental criteria we then add it to a watchlist and use technicals ONLY FOR TIMING ENTRY, not for idea generation.

Aehr Test Systems (NASDAQ: AEHR)

This stock has had impressive earnings and it is not just a one-time thing. The past 5 quarters have all seen triple-digit percentage gains.

They reported RECORD annual revenue as well as RECORD annual bookings (demand is there to back up revenue).

This quarter they saw:

+475% increase in the quarterly EPS on a y/y basis

+166% in the quarterly sales on a y/y basis

Going forward they are estimated to see a +24% increase in 2023 annual EPS and a 100% increase in the 2024 annual EPS.

The expectations of the future of this stock is worth putting the stock on a watchlist.

Fiscal 2023 Financial Guidance:

“For the fiscal year ending May 31, 2023, Aehr expects total revenue to be at least $60 million to $70 million, with strong profit margins similar to the last fiscal year. Aehr also expects bookings to grow faster than revenues in fiscal 2023 as the ramp in demand for silicon carbide in electric vehicles increases exponentially throughout the decade.”

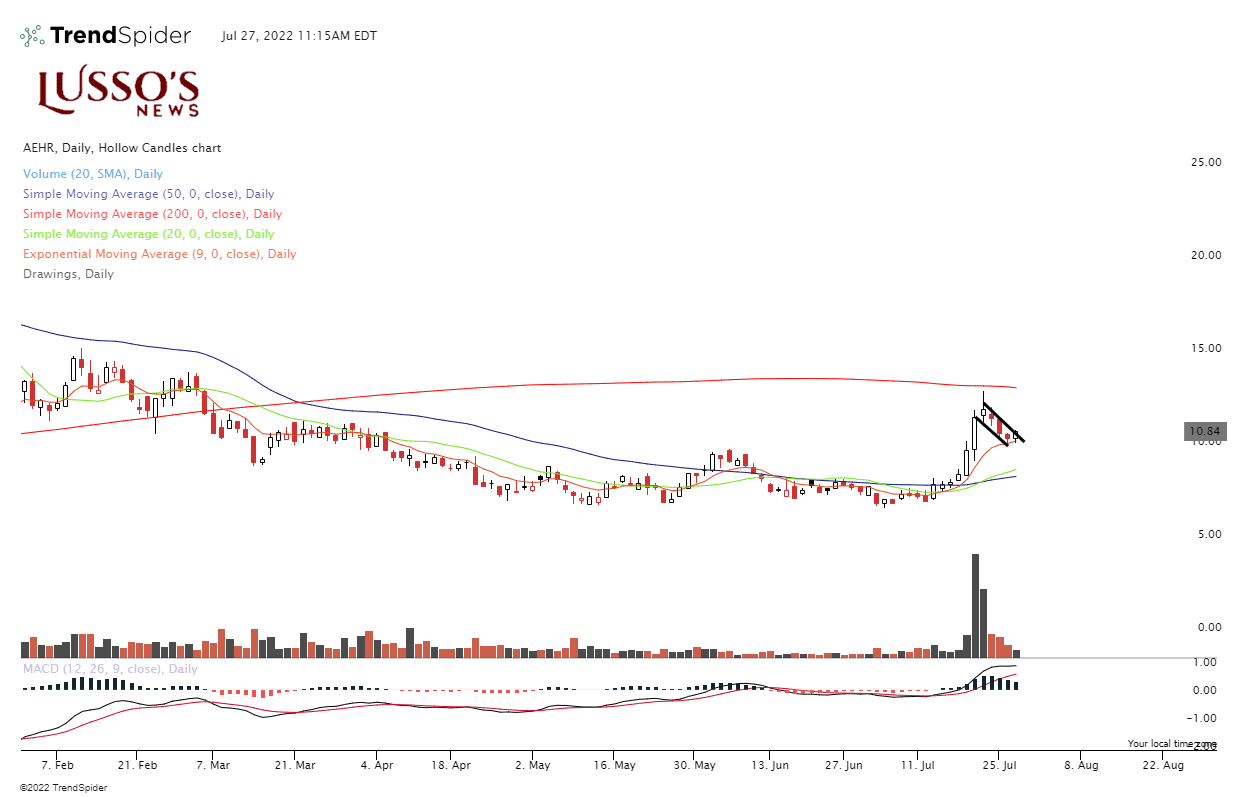

Looking at the chart you can see that the concern is, that it trades below the 200-day simple moving average.

Currently, it is flagging on the daily chart while volume is decreasing after a strong recent run-up in price.

With the continued high growth y/y that the company report and the continuation of the ability to beat analyst expectations for earnings, AEHR is a stock to watch.