Hello Traders and Investors,

This report will cover:

Market Wisdom About Current Conditions

Update on our Rare Stock

Market Breadth…In Detail

Stocks To Watch

US Dollar

Bottom Line

Before we get into our report, I want to share some wisdom with everyone.

When participating in the Financial Markets you must have an identity. You need to know who you are as a trader or investor. Most importantly you need a methodology/system/process that you follow religiously.

If you lack a methodology, then the current market environment will hurt you in many ways, you will be making on-the-fly decisions and that could result in very volatile PNL swings in your portfolio.

Another thing you must have as a trader and investor is SITTING OUT POWER. When your methodology is not applicable and your thesis/conviction is not strong, then you need to have the ability to SIT OUT! This is a key to protecting the money that you have!

Right now, we are seeing a very volatile market that has been moving lower sharply. The bias is strong to the downside and with every move lower, it only raises the conviction of the bearish bias.

As a participant in the market preparation and research is key. The time to buy may not be now but, when that time comes, we want to be prepared. We want to know what stocks have the potential for growth, what companies are strong, and simply put…we want to be prepared for opportunities when they arise.

MASSIVE OPPORTUNITY

During Covid-19 I felt the strong/stable companies were able to lighten up their balance sheet by cutting unneeded expenses/costs. I felt many companies would come out of the pandemic with a lighter balance sheet. We have seen this with DIS 0.00%↑ and many other companies, where they cut the categories that weren't working out of their stream of business.

In my hypothesis, I felt like this was good for the long run but now, with the current economic contraction, the leaders will LEAD by a wide margin in my opinion when the FED pivots.

Let me explain quickly…

Many companies took on excessive debt during a bubble phase of the markets while strong companies and the leaders, cut their balance sheets the other companies took bets to invest and grow.

If we do see a sharp recession, the companies that took on more high-risk debt in the bubble phase may get wiped out and as a result, this will be bullish for the LEADERS because they will only gain more dominance in their market share.

Let’s look at an example:

You have a stock such as DKNG that spends a lot of money and is not profitable.

On the other hand, you have a company such as PENN. Who has a healthier balance sheet than DKNG, they don’t spend a fortune on ads and they are profitable.

If a recession hits hard, a company like DKNG will get hurt and in a result, a stronger company such as PENN will be able to DOMINATE its market space when the tide shifts.

DKNG may have to go MORE into debt during a bad economy which will cause investors to favor a stock like PENN.

My thesis is, the leaders will lead and the laggards will lag!

Many novice investors and traders may look to buy DKNG instead of PENN because it has a ‘cheaper share price’ but, they may not understand how business cycles work and how balance sheets work. Of course, this is just an example of two stocks in the same industry and is not a valid thesis.

This is why it is essential to stay on our reports because we feel rolling up our sleeves, and doing the hard work of fundamental analysis to correlate with our technicals will present massive opportunities when the FED pivots.

In the meantime, sitting out power is essential to defending and protecting our money.

Let’s use this time to put ourselves in a position to succeed in a large manner when opportunities arise.

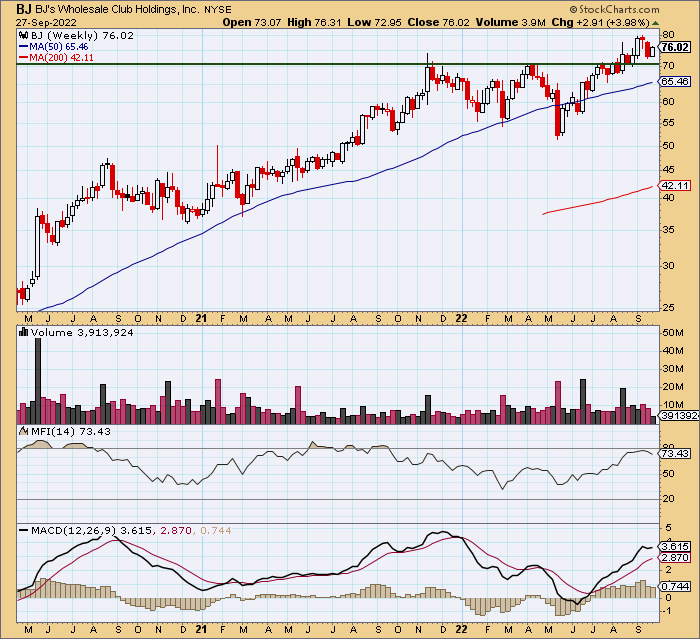

Before we get into the market breadth segment I want to congratulate everyone on the strength of BJ 0.00%↑ .

We covered the earnings on this one here for our paid readers: RARE STOCK, Great Earnings + Great Technicals (substack.com).

Costco use to be seen as a recession-proof stock because their average household income per shopper was strong but, Costco’s share price was inflated during the market boom!

On the other hand, BJ 0.00%↑ took their gains from high gas prices and they invested those gains back into the company to expand and grow.

They are expanded rapidly as well⬇️

The company is in pure growth mode in fact from 2016-2020 they opened only 10 new clubs and now they expect to open 11 new clubs this fiscal year and as well open 10 clubs+ every year from here on out! THIS IS BIG!

Market Breadth

It has been about a week since we reviewed the market breadth.

Lets take a moment to review and reflect⬇️

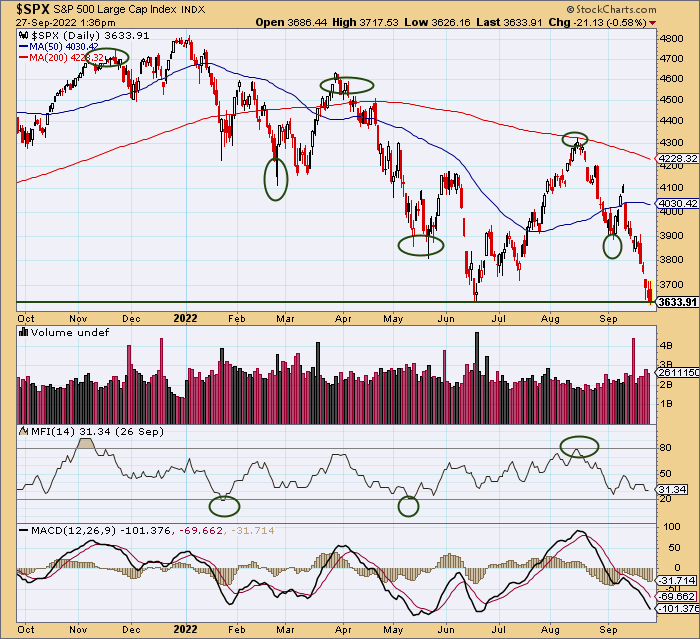

Money Flow Index (MFI) On $SPX

Despite the potential double bottom currently on the S&P 500, the MFI has not reached the area of prior support showing a potential buy signal.

As you know from previous reports, we want to see this in the lower 20s to really help us have a higher conviction of a rally based on historical analysis of this indicator.

If we do get a few more days of selling or a day where we see a large down day -2% or more then we want to refer back to this chart to see where the MFI is at.

The MFI has been a strong indicator in the past for a short-term bottom/top and we want to continue to watch this.

30 is still low for the MFI and with that being said we have to be on watch for a bounce.

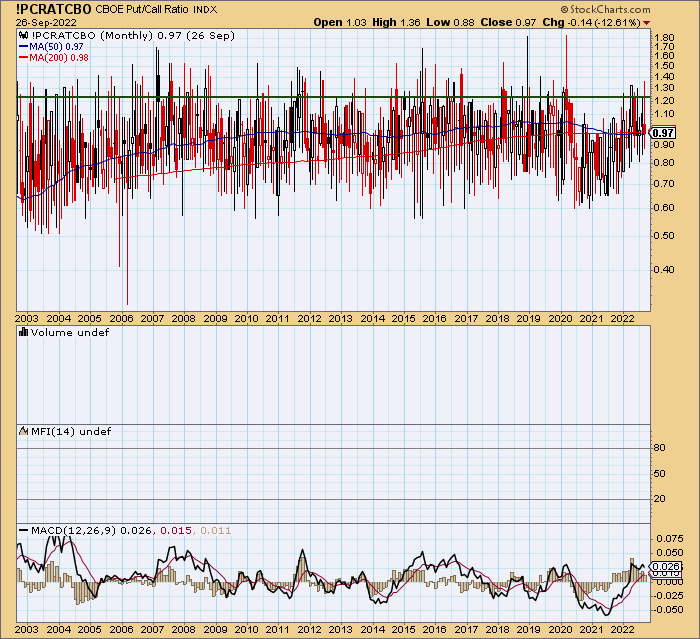

CBOE PUT/CALL RATIO

The Put-Call ratio is now under 1. People have shifted towards a bias of bounce to come in the market it appears. Shorts are hedging their bets by buying calls.

We have to be prepared for a potential bounce.

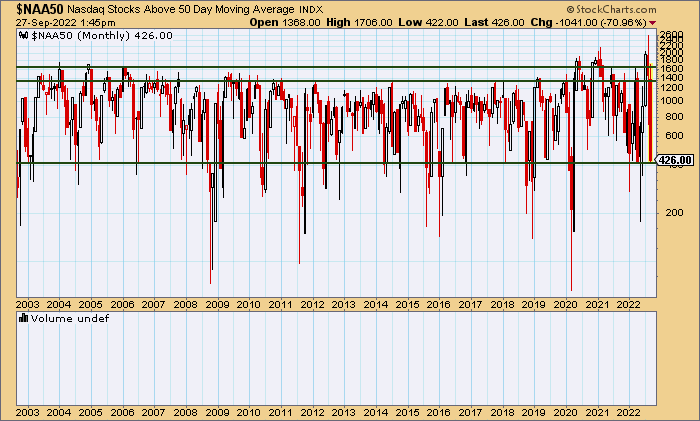

WOW….NASDAQ STOCKS ABOVE THE 50DAY MOVING AVERAGE

I say wow…because, if you have been reading our reports then you know this is a LARGE SWING on this chart.

We went from, all-time high levels to now at a bottom support level.

Historically, this current level shows a support area but, in the past, it has also moved a lot lower during significant events.

This monthly candle has been one of the worst monthly candles in the last 20 years.

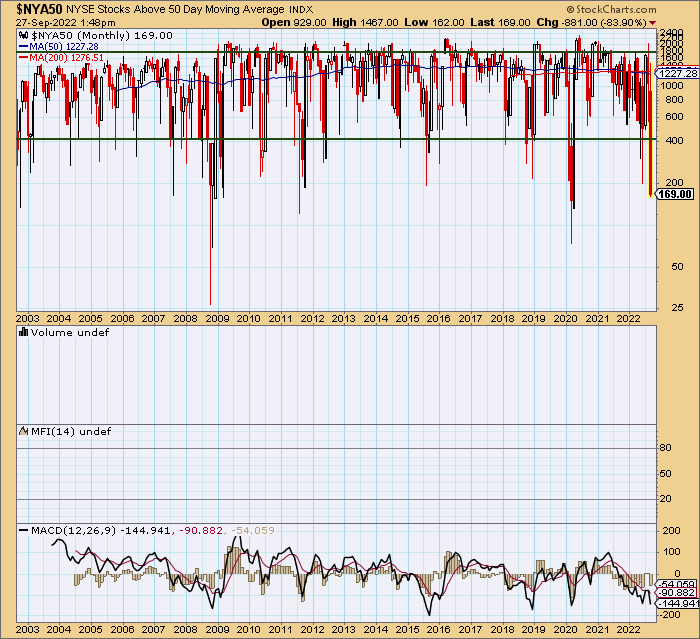

NYSE STOCKS ABOVE 50 DAY MOVING AVERAGE

This chart shows it is oversold. The amount of NYSE under the 50 day moving average is historically screaming, oversold.

Takeaway

After analyzing the market breadth, we can see that the market is oversold in the short term and there is a valid thesis for short-term traders to be bullish.

We have to have humility and stay humble though because we do not know if a bounce will occur we can only make a hypothesis using the information in front of us and comparing it to history.

Timing the bounce will be difficult to maintain a good risk reward and in a result, if you are a trader who likes to trade short term then waiting for confirmation of strength before anticipating it, maybe a safer route and is the route I take.

I prefer to take the meat of the move instead of nailing tops or bottoms.

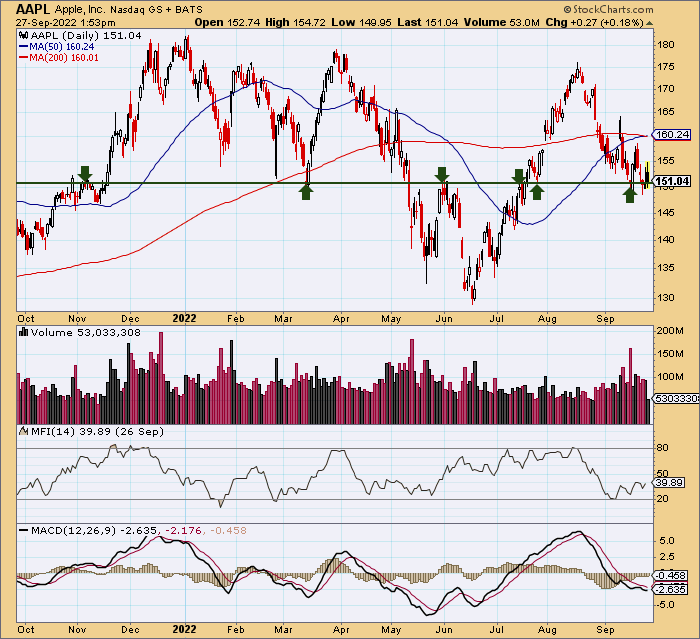

AAPL

Apple is the Tom Brady of the markets.

The stock has been very strong and holding the 150 area despite markets plummeting.

When AAPL performs well, the media covers it…non stop. In a result, more money flows into AAPL after everyone realizes it is holding up well.

The amount of shorts involved in AAPL is high.

Given its strength, holding up at a KEY area and the current market breadth, it is appropriate to maintain this stock on your watchlist.

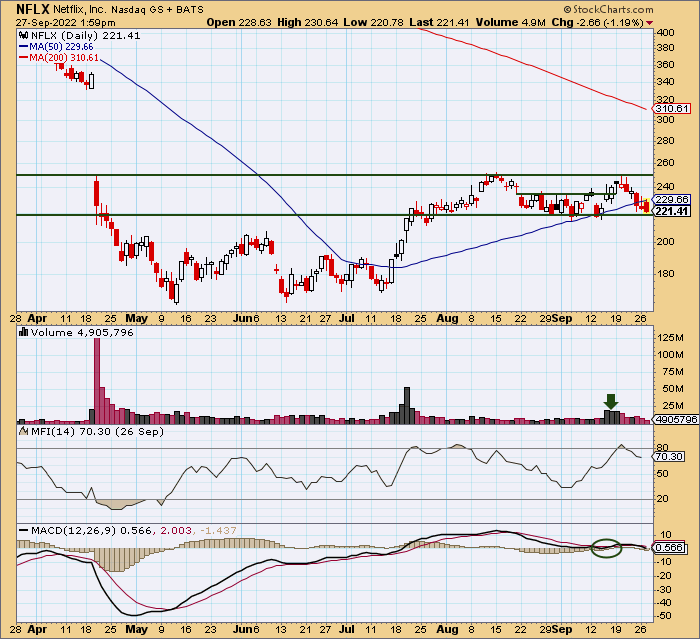

NFLX

NFLX is a stock that saw accelerated volume come into it 3 days in a row before it double topped around $250.

This company is the future of STARS meaning, we continue to see more and more household actors, act in Netflix originals.

Despite its failures, the company has yet to see its peak in my opinion based on multiple users per 1 account they have yet to fix and gaining massive money from advertisements.

The stock pulled back to a lower area of prior support on volume that was minimal.

If the market bounces, NFLX is a stock to watch due to the risk/reward at the current levels.

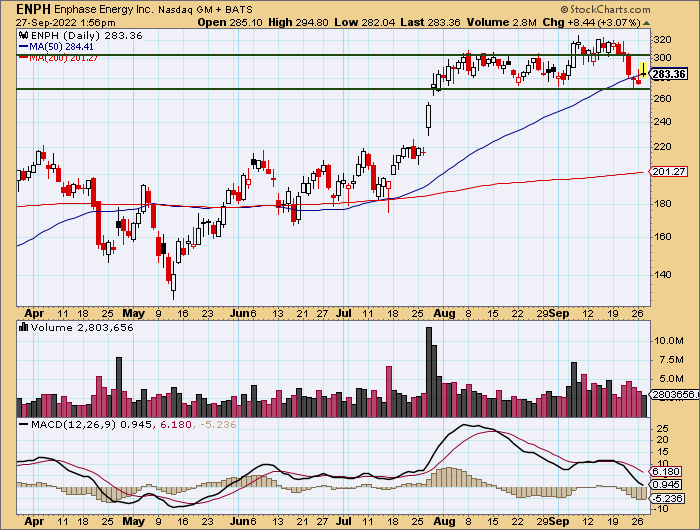

ENPH

ENPH is a market leader. The stock is up 53% YTD vs the SPY down -24%.

This stock moves very thin and in a result, could recover quickly to the 320 area if the markets bounce.

It is still trading in its channel since August and $300 will be the key area to watch as well as the 50 day moving average.

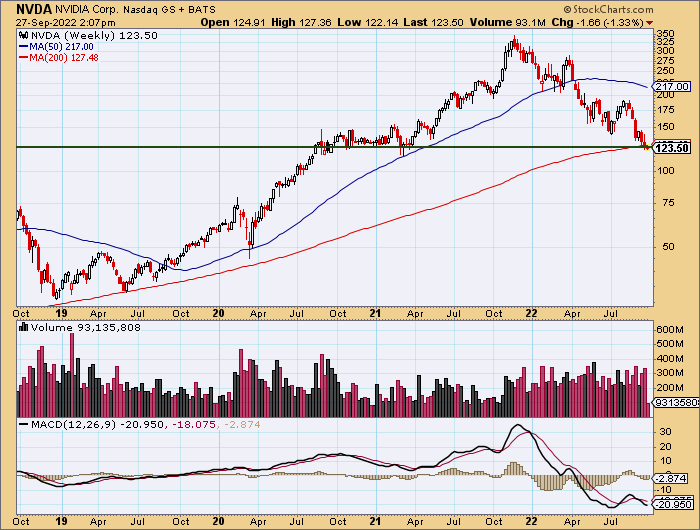

NVDA

NVDA has been selling on very high volume but, for two weeks in a row it has held around key support areas:

200-day moving average

Prior Support from 2020

Going against the trend is ill-advised but, based on the market breadth analysis we covered, we feel NVDA is worth watching largely due to the potential reward vs risk for a shorter-term trade if we do see a bear market rally.

TIMEOUT

Let’s review and discuss a common theme we are seeing.

We are seeing a common theme…popular stocks are holding key areas despite market selling!

We are seeing stocks such as AAPL NVDA NFLX ENPH all are at or near key areas!

We are seeing the S&P 500 potentially double bottoming in the short term

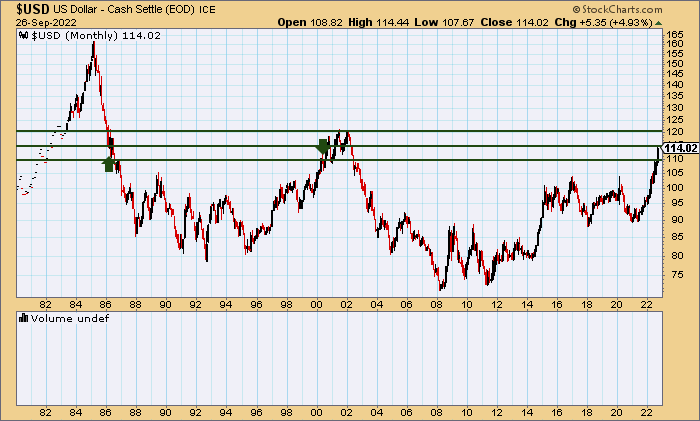

Now we turn our attention to the US Dollar.

US DOLLAR

As many of you know, the US Dollar is the KING of Financial Markets.

A strong dollar simply hurts growth and growth stocks and as a result, the NASDAQ suffers.

As the dollar broke out STRONG over $110, which was a MASSIVE breakout…it is now looking a little overextended in the short term.

Looking at history you can see around $115 has been an area of prior support and prior resistance.

Currently, it is right around this area.

Given all of the stuff we covered above, if the dollar pulls back here, that will be the icing on the cake for a bounce to be probable.

Bottom Line

The bottom line is we need SITTING OUT POWER and we need HIGH CONVICTION to get off our hands!

We feel, in our opinion, based on the data in front of us a bounce could be in the cards…SOON and once price action confirms strength then we will have a raised conviction that could result in us trading the bounce.

The market is volatile and as result growth stocks will most likely see the largest volatility given the US Dollars activity.

Many stocks will be cheap when this bear market is all said and done but, there will be stocks that do not recover. We need to work now, to prepare ourselves to find the bargains and make sure we do not get into a company that will not recover.

Stay safe, manage risk, and trade only when the conviction of your thesis is raised.

DISCLAIMER: Lusso’s News LLC offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at Lusso’s News, LLC on a written article, post, newsletter or comment, you agree to hold Lussosnews.Com liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lossed at any time. Lusso’s News, LLC never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at Lusso’s News, LLC may be buying or selling any stock mentioned at any given time. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Lusso’s News, LLC Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Lusso’s News, LLC recommends you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk-free” industry. If you do agree to this, then please exit our website now. No Refunds at any time.LUSSO’S NEWS, LLC IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, Lusso’s News, LLC nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education. THE ABOVE POWERHOUSE REPORT INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND DISCLAIMER. OUR REPORT IS FOR INFORMATION PURPOSES ONLY AND IS NOT BUY OR SELL INVESTMENT OR TRADE ADVICE. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED AND FULL RISK APPLIES OF LOSING MONEY ON A TRADE. OUR WRITERS AND TRADERS ARE NOT LICENSED OR FINANCIAL ADVISORS.