Use Code ‘LN25’ To Get 25% Off At TrendSpider.com With your 7-Day Free Trial

Hey Traders and Investors,

We are back again to go over some stocks that reported earnings today. Our criteria is SUPER strict and we never adjust our criteria. We want to see HIGH GROWTH and many of the names we feature you may have never heard of but, that is fine because most of you have probably never heard of APPS 0.00%↑ when we featured it in 2020 before it ran 100’s of percent.

If you missed last night’s report on earnings from 7/27 you can read that as well.

Mastercard (MA)

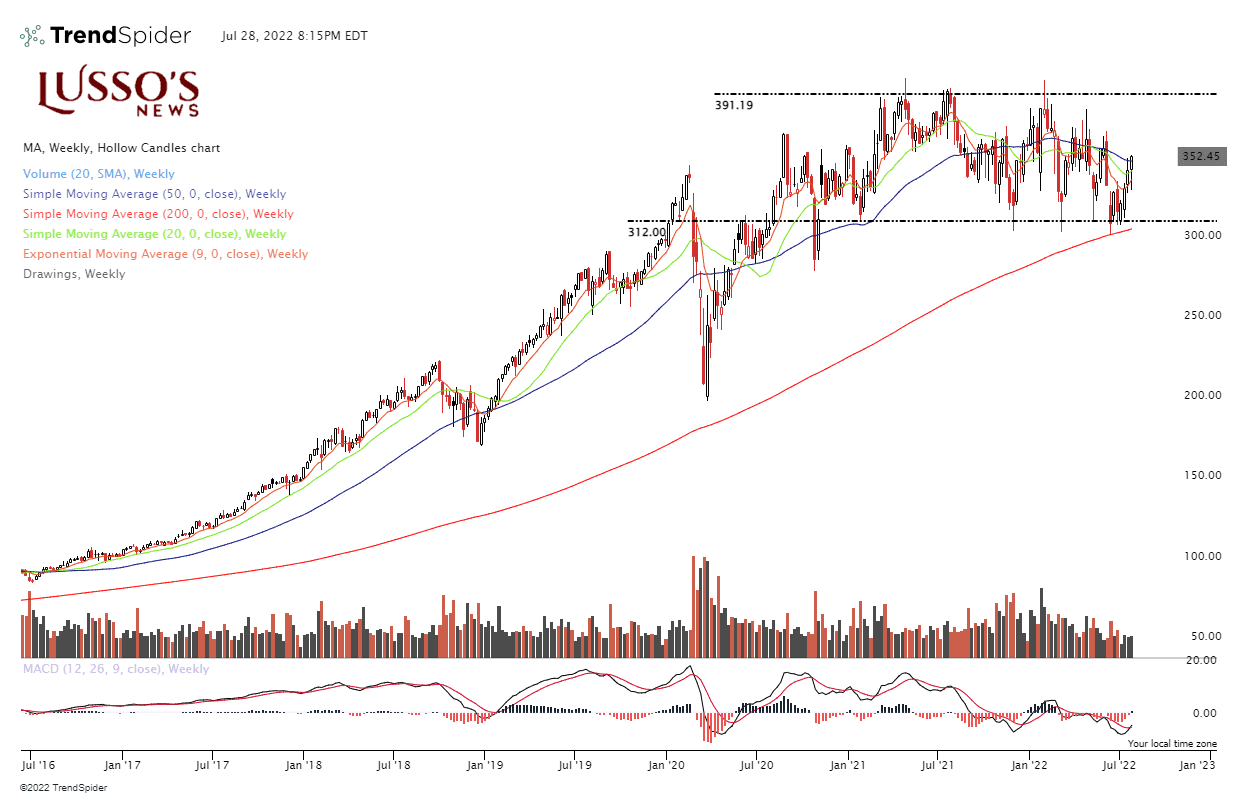

Mastercard is a stock that has been hovering around pre-pandemic levels for nearly 2 years now.

What can cause the stock to finally break out?

As traders, we always want to look at cause and effect.

Now, MA has reported multiple quarters in a row of a consistent steady growth of around 30-50% and this quarter was no different.

Reported a +31% increase in their quarterly EPS on a y/y basis

Reported a +21% increase in their quarterly revenue on a y/y basis

I read through the entire earnings call and I will say this…this is nothing ‘exciting’ but, is ‘good’ if that makes sense!

What I mean is, that it is not going to get you a 200% return in a short period of time but, it has solid fundamentals and continues to see growth supported by an appealing chart.

On the weekly chart, you can see that it has been trading sideways for nearly 2 years now but, the weekly MACD is nearing a bullish convergence which could spark momentum into the stock.

As I said, this is not anything exciting but, it is a solid company to keep on a watchlist.

GFL Environmental (GFL)

You probably never heard of GFL 0.00%↑ before and you may never even of heard of its industry group Pollution Control but, this company had a very nice growth quarter and is stock on HIGH-ALERT.