Happy Sunday Traders,

What a week we have in front of us with the FOMC meeting/expected rate hike this Wednesday as well as earnings being reported on Big tech this week AAPL 0.00%↑ AMZN 0.00%↑ META 0.00%↑ MSFT 0.00%↑ GOOG 0.00%↑

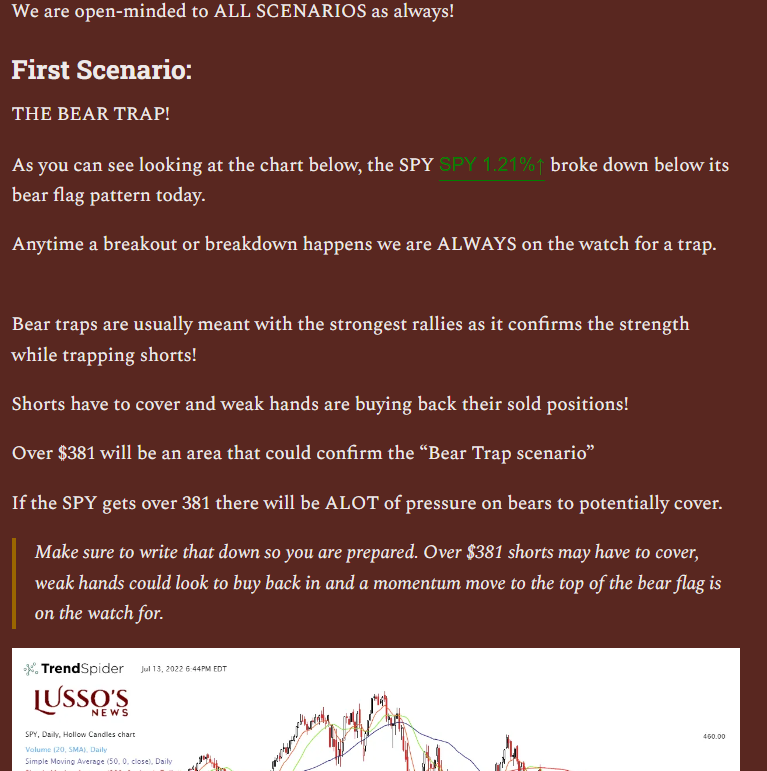

As many know who read our reports, we had issued a potential bear trap scenario as the SPY 0.00%↑ fell below the bear flag.

We stated that the SPY could rally to the top of the bear flag because traps are usually meant with the strongest reversals.

To an extent, it did just that.

We also issued a warning as well on a previous report that if the:

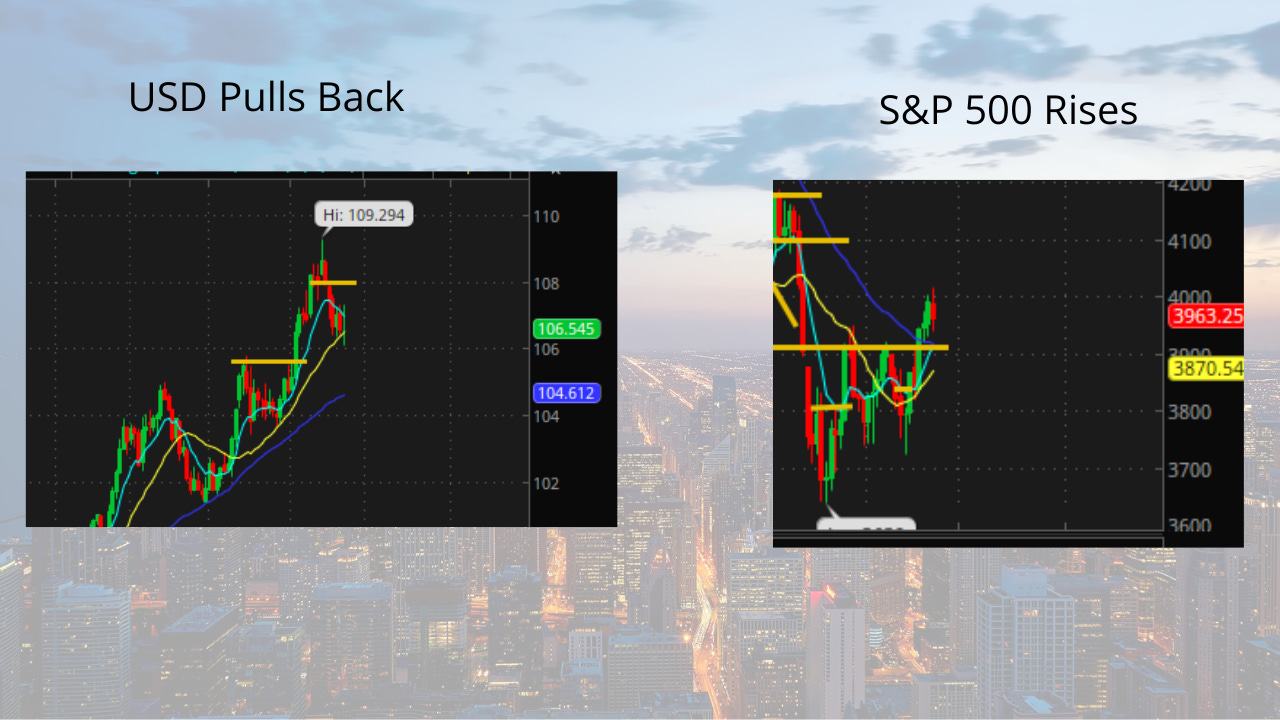

“US Dollar pulls back then we 100% want to be watching equities to see if demand does come in and stocks mover higher.”

If the USD ($DXY) can regain back above $108 then it could put pressure back on growth /Nasdaq stocks so this is something to monitor closely.

Another Factor For A Weaker Dollar…

As the USD is king of markets, the dollar has risen because it has acted as a safe haven as many economies are in turmoil.

Many economies especially the EU have taken a hit because of the oil prices but, our thesis was if Crude falls, then the $EURUSD can rise and it did exactly that!

This week we want to carefully watch Crude Oil because a drop in Crude at the current levels could be bullish for equities for many reasons.