Good evening traders and investors,

Everyone knows about the CPI numbers reporting higher than expected so we are not going to talk about it as we want to talk about how we can potentially make money in this current trading environment.

We are all here to make money, no one is going to risk money not to potentially make money.

So how do we make money in this current environment?

I am going to give you a tip…

Also, if you have NOT become an exclusive access reader yet the time to do so is NOW because the 20% off for life expires in a few days!

Here is a tip…

Before the market indices bottom, the new market leaders are already off to the races. This is why they are called leaders!

Leaders lead!

So during the environment we are in and the current stage of the bear market, we have to look every day at what stocks are strong and are set up on nice channels.

Luckily for you guys and gals, we cover this for you in our exclusive reports!

S&P 500 Overview

Last Friday we called the top on SPY as well alerted everyone we were taking our foot off of the gas.

We said once again on Sunday’s report we were taking the foot off of the gas again.

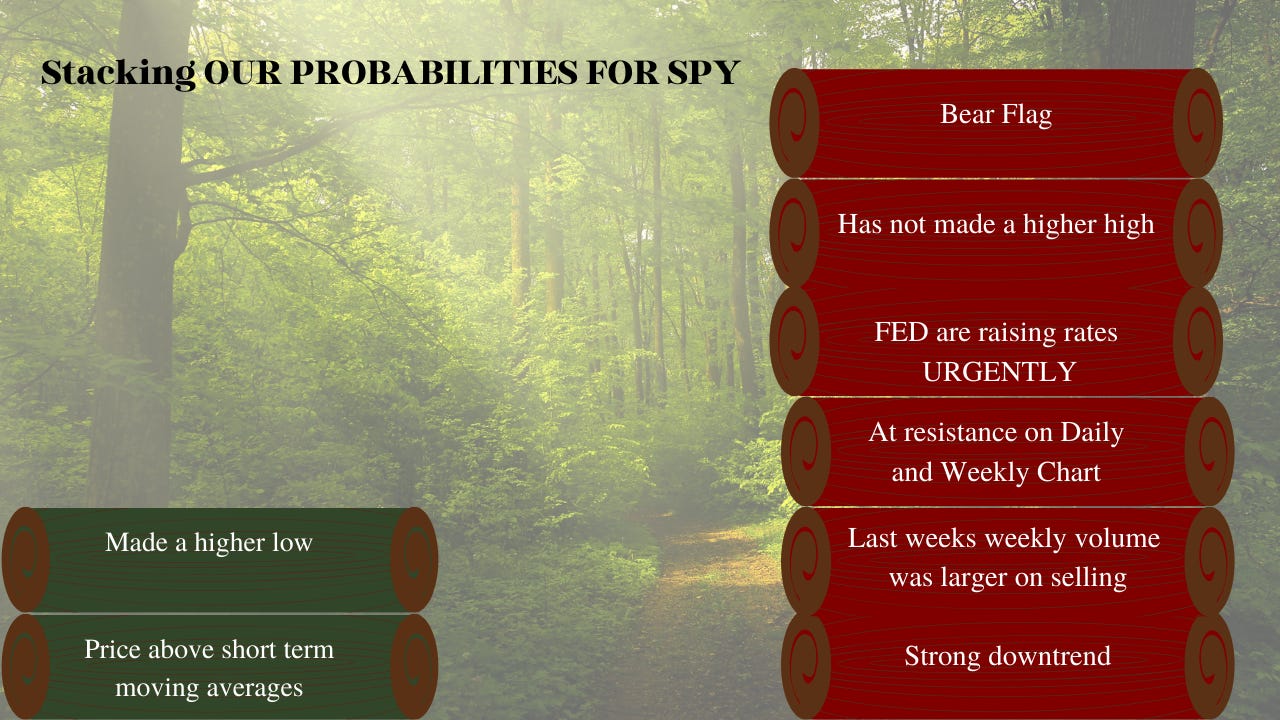

We should a visual of how probabilities were stacked AGAINST bulls.

So Where Do We Stand Today?

We are open-minded to ALL SCENARIOS as always!

First Scenario:

THE BEAR TRAP!

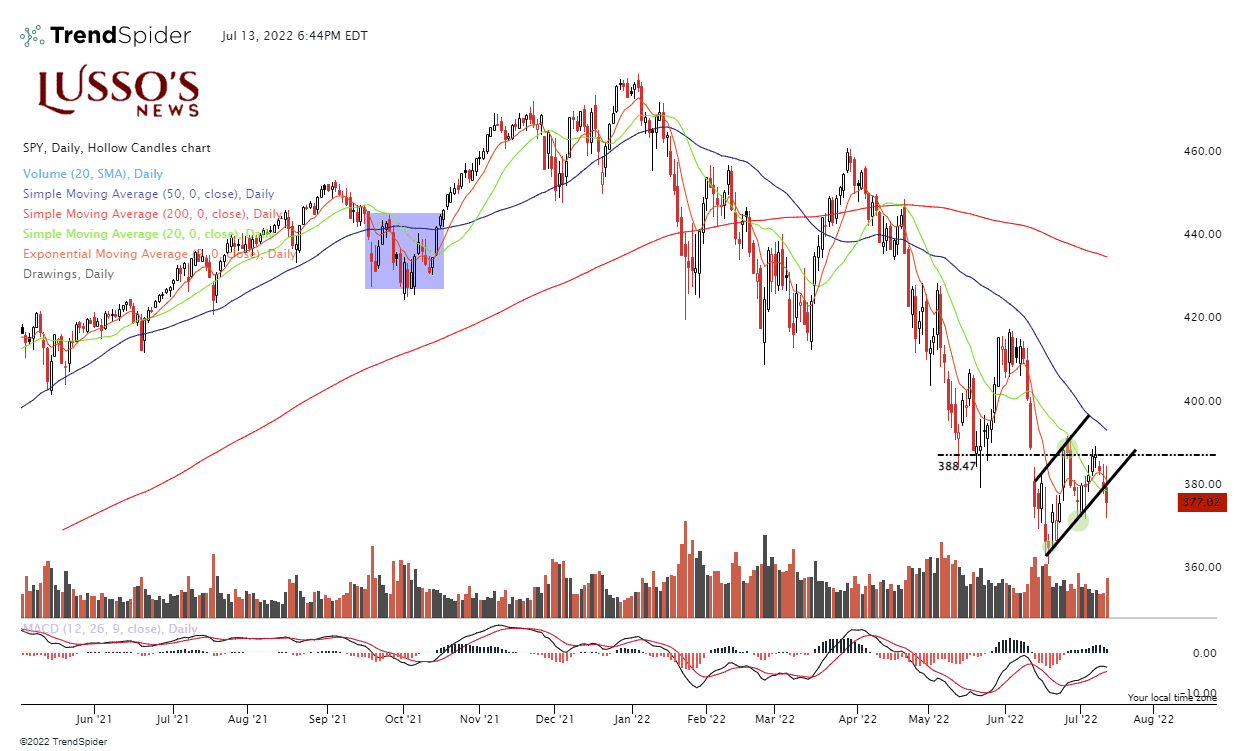

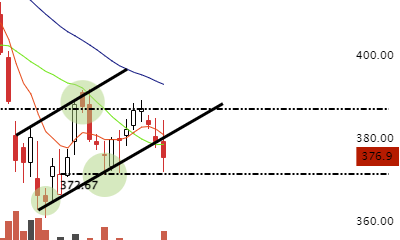

As you can see looking at the chart below, the SPY SPY 0.00%↑ broke down below its bear flag pattern today.

Anytime a breakout or breakdown happens we are ALWAYS on the watch for a trap.

Bear traps are usually meant with the strongest rallies as it confirms the strength while trapping shorts!

Shorts have to cover and weak hands are buying back their sold positions!

Over $381 will be an area that could confirm the “Bear Trap scenario”

If the SPY gets over 381 there will be ALOT of pressure on bears to potentially cover.

Make sure to write that down so you are prepared. Over $381 shorts may have to cover, weak hands could look to buy back in and a momentum move to the top of the bear flag is on the watch for.

Second Scenario:

THE BREAKDOWN!

This is the most obvious scenario because:

SPY is in a downtrend

It broke down below a bear flag

FEDs actions are very bearish for stocks

We expect the price to go lower here but, as Paul Tudor Jones says: “If it is obvious then it is obviously wrong”

So right now we are prepared for a breakdown, if the bear flag was legit then we should, in our opinion see the SPY fall below the lows in June.

We are also prepared for a strong reversal/trap if it reclaims over $381 as well!

Third Scenario:

THE SIDEWAYS CHANNEL!

Let’s watch to see if the SPY can trade in a range from $372 to $388.

Around $372 has been an area of support multiple times and today it bounced off this area once again!

Around $388 has been an area of resistance as well.

So to summarize, we now have 3 very solid theses for the SPY.

Bear trap if SPY moves over $381

A continued breakdown below bears a flag with the potential for breaking June’s lows.

Sideways action between $372-$388

Three Tips To Watch For The Market To Shift Momentum to The Upside

USD! We want to watch the USD. If the dollar can pull back then we would turn our attention to equities to see if stocks can really. Watching the USD $DXY is critical as a strong dollar is bad for growth stocks but, if it does pull back we want to be prepared to take a trade to the long side on equities.

10-year treasury note futures is something we watch. If the T-Notes can move higher then we want to turn our attention to stocks, more importantly, tech stocks.

Keep a watch on $372 on SPY. This is an area of support multiple times.

Speaking of Bear Flag…

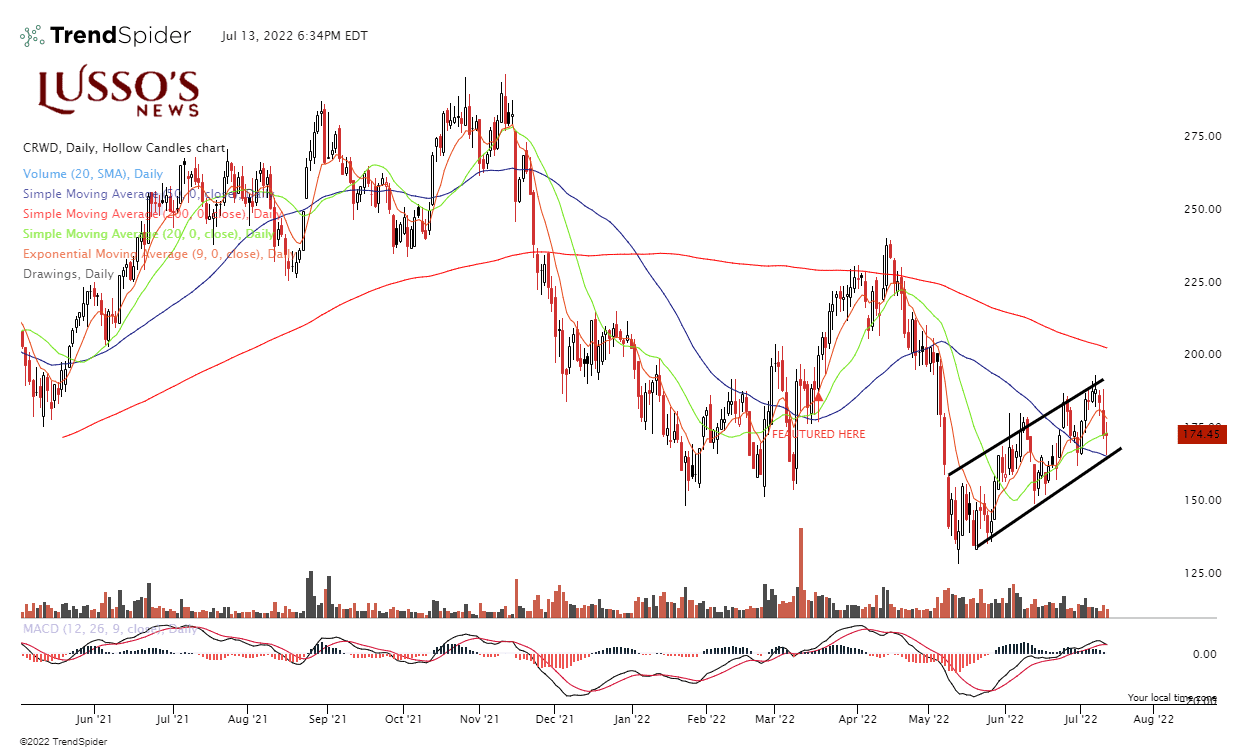

CRWD 0.00%↑

We featured CRWD as a short as it was near the top of the bear flag.

Today it did touch the bottom of the bear flag and is on the watch for a breakdown below the bear flag.

Stocks We Are Seeing Strength In

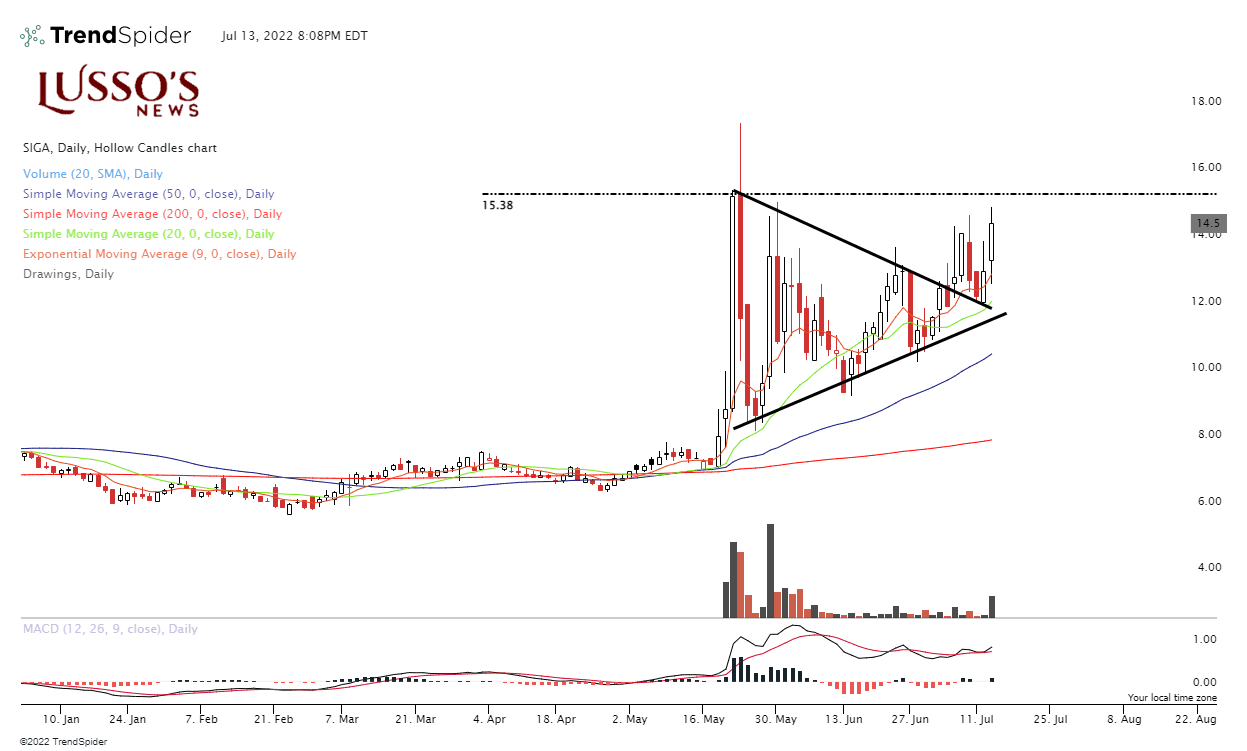

SIGA SIGA 0.00%↑

We have been covering SIGA since before it broke out of this pattern but, we have many new readers and I want to feature this again because today it had a strong day on high volume.

The next big level for this stock will be around $15.30.

As you can see once it broke out of this triangle it held above the breakout level as new support. This is bullish.

Congrats to those who nailed this for a swing trade as it is up about 40% since we featured it.

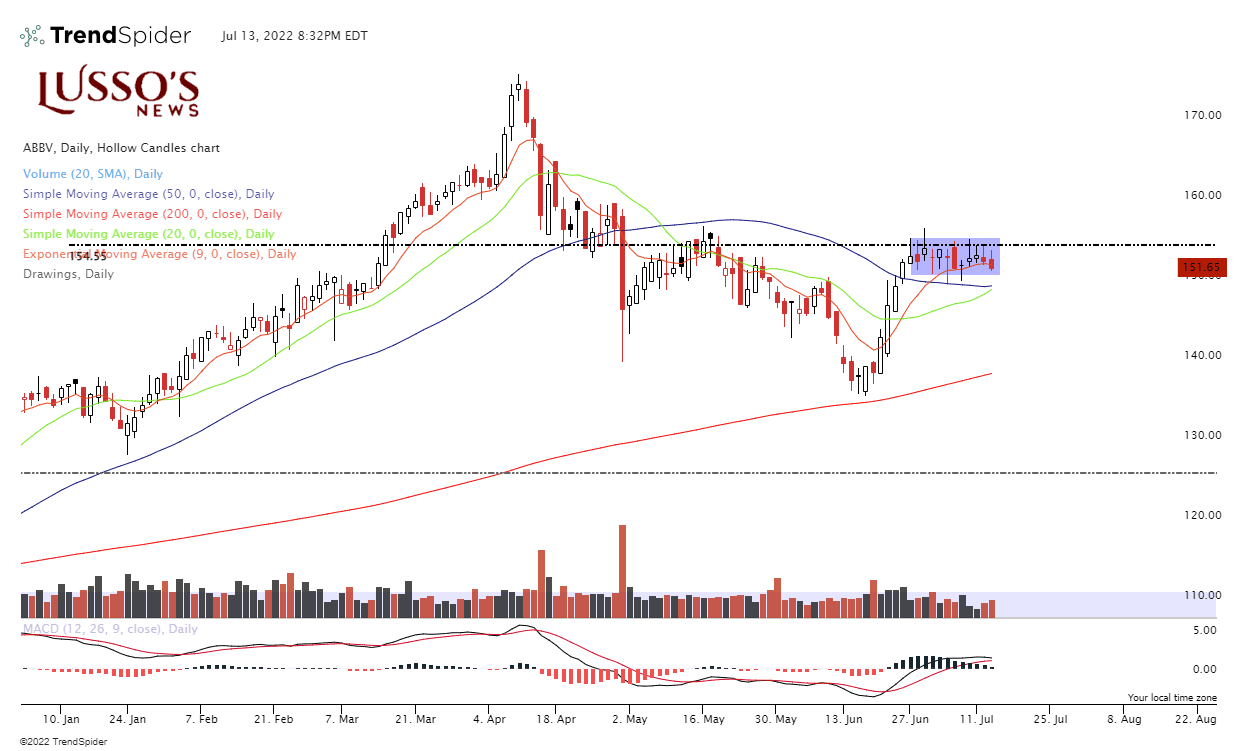

ABBV

We will continue to feature ABBV until we don’t like it anymore.

Re-Read our Sunday report about this stock.

Over $155 is where we are interested in taking a position for a swing trade.

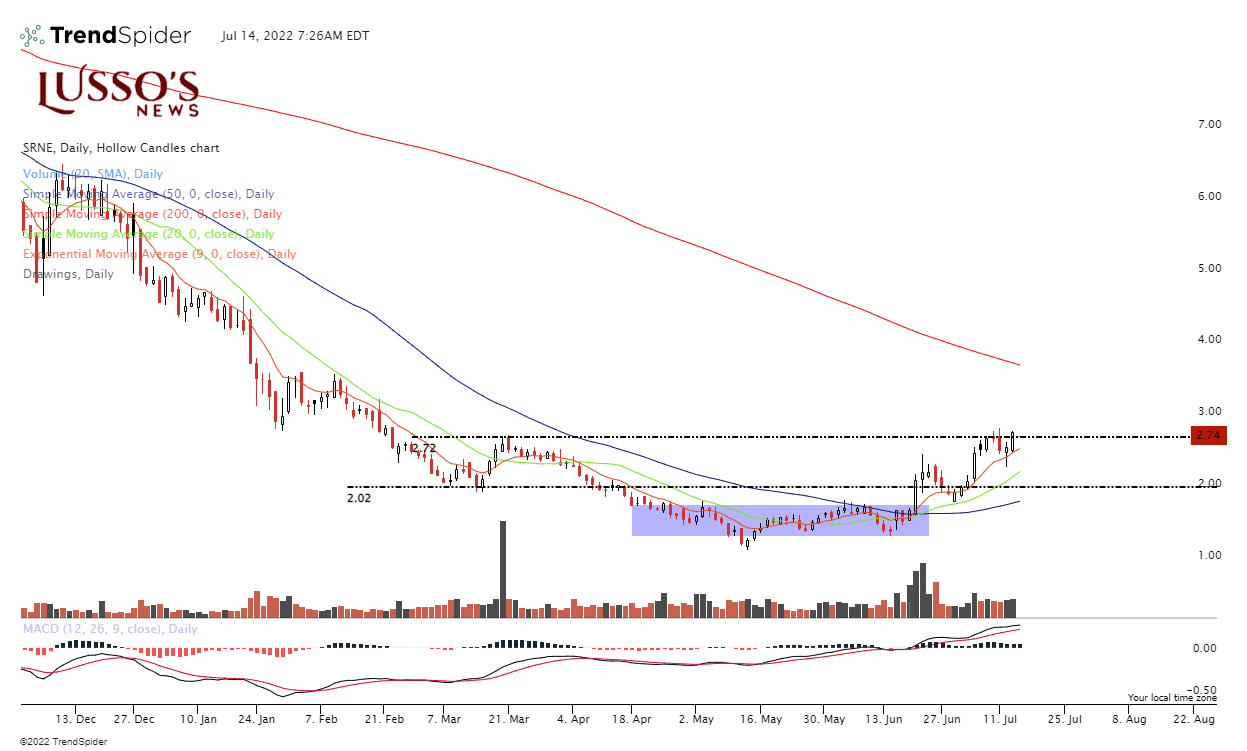

SRNE

SRNE is a very nice looking chart and we featured this stock at around $2.11 as well as featured it on a Golden Ticket Trade.

You only need a handful of good-performing stocks and SRNE has been a good performer.

It had a VERY strong close yesterday and is nearing a breakout out of this sideways range it has been traded in.

Let’s keep this on watch over $2.86 today but, a lot of our readers are still holding this swing trade from around the $2.20’s so well done!

The Bottom Line

The biggest thing to watch today is the USD!

The bottom line is patience and the ability to be poised are two traits you must have as a trader.

You have to know when to trade and when not to and only trade A+ opportunities!

The SPY broke down below a textbook bear flag which we have alerted for weeks and if this pattern is intact we could see a meltdown below June lows.

It is EXTREMELY IMPORTANT to have a plan in this kind of environment. You do NOT want to make an instant decision that is not thought out because you can lose a lot of money very fast this way.

We said on Friday and on Sunday we were taking our foot off of the gas! We do expect to be VERY AGGRESSIVE in our report this weekend as earning season is here.

We have Episode 1 coming Tomorrow or Saturday available to our exclusive access traders on how to reading volume.

DISCLAIMER: Lusso’s News LLC offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at Lusso’s News, LLC on a written article, post, newsletter or comment, you agree to hold Lussosnews.Com liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lossed at any time. Lusso’s News, LLC never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at Lusso’s News, LLC may be buying or selling any stock mentioned at any given time. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Lusso’s News, LLC Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Lusso’s News, LLC recommends you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk-free” industry. If you do agree to this, then please exit our website now. LUSSO’S NEWS, LLC IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, Lusso’s News, LLC nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education. THE ABOVE POWERHOUSE REPORT INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND DISCLAIMER. OUR REPORT IS FOR INFORMATION PURPOSES ONLY AND IS NOT BUY OR SELL INVESTMENT OR TRADE ADVICE. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED AND FULL RISK APPLIES OF LOSING MONEY ON A TRADE. OUR WRITERS AND TRADERS ARE NOT LICENSED OR FINANCIAL ADVISORS.