A few months ago steel stocks were the leaders and the bright stocks in the market. Despite the S&P 500 moving lower, stocks such as Steel Dynamics, Inc [NASDAQ:STLD] and Nucor Corp [NYSE:NUE] were taking flight.

“STLD and NUE were both called on our premium readers list at Substack before they took flight.”

Why Are These Stocks Back On Watch?

Both STLD and NUE are back on the public radar not only from a technical aspect but, from a fundamental aspect as well.

Most recently, STLD and NUE did report their earnings and they showed the ability to continue to see quarterly growth on a year-over-year basis!

But….

Is there concern?

Steel Dynamics (STLD)

Last week STLD did report an earnings beat on both Sales and EPS.

They reported:

The reported Quarterly EPS was $6.73 which BEAT the estimates of $6.34.

This represented a +98% growth on a year-over-year basis for the quarter.

The reported Quarterly Sales were $6212.9($MIL) which was a record and it bears the estimates of $6066.3.

This represented a +39% growth on a year-over-year basis for the quarter.

The company is now expanding into the Aluminium industry which was news they announced last week.

“It’s been – it was exciting to announce our new growth initiative on Tuesday with our entry into the aluminum market.”-CEO, Mark Millett

The company continues to see records on their earings. This is what the CEO had to say on the earnings call:

“…exciting to announce yet another record quarter, record consolidated volumes, earnings per share, cash flow, all supporting our cash allocation strategy and commitment to building shareholder value” CEO, Mark Millett

Often, most of the time the company CEOs are the biggest cheerleaders so we have to not be ‘sold’ on the earnings call because they always try and make it sound…EXCITING!

This is why I always ask, “if the company is so good, how come you are not investing back into it?”

And the answer is…THEY HAVE BEEN!

They repurchased $517 million worth of the company’s common stock, which represents 3.5% of their outstanding shares in the quarter.

Going Into Economic Times Of Uncertanty…

…it is important to be LIQUID!

As a company during a potential economic slowdown, liquidity is key and if a company is NOT liquid then they are potential short candidates, especially if they have a lot of debt!

That is NOT the case with STLD as the CFO, Theresa Wagler had this to say on the companies earnings call:

“At the end of June, we had record liquidity of $2.5 billion, comprised of cash and short-term investments of $1.3 billion and an undrawn unsecured revolver of $1.2 billion. We generated record cash flow from operations of $1 billion in the second quarter and $1.8 billion year-to-date.”

The company still has about $727 million in authorized share buybacks they can use and they were able to maintain their newly 31% raised dividend (in Q1) at $0.34 per common share!

Looking At The Chart

Looking at the weekly chart you can see that price did pull back to a prior resistance level.

This prior resistance did appear to hold as new support, at least, for the time being. With this being said, in our opinion, STLD needs to hold and trade above $66 for a bullish thesis to maintain a positive.

Takeaway

After seeing Walmart (WMT) give rocky guidance and a rocky quarter and many of the Big Tech companies announcing layoffs, STLD earnings appear to be light in the darkness. The company continues to grow and most importantly they are investing in the shareholders with raised dividends and share buybacks. This is a stock to continue to watch.

Nucor Corp (NUE)

Another steel stock that trades very similarly with STLD is Nucor Corp [NYSE: NUE].

This stock was able to rally from $30 to $187 and most importantly, it was able to rally and stay strong despite a weak S&P 500 in 2022.

Since its massive rally, it had pulled back with the entire Steel-Producer industry group but, the company recently reported earnings and saw a similar quarter to STLD which confirms strength in this industry.

On The Quarter;

The reported Quarterly EPS was $9.67 which was a +92% increase on a year-over-year basis

The reported Quarterly sales were $11.8 ($BIL) which was a +34% on a year-over-year basis

The company did see RECORD breaking quarter results just as STLD did.

Here is what the CEO, Leon T. had to say:

“We achieved record second-quarter earnings per share of $9.67 and record first-half earnings of $17.30. This record performance was driven by strength across our diversified portfolio of businesses. Strong financial results were recorded by a number of our businesses, including bar, plate, sheet, structural, joist, deck, buildings, tubular, and our raw material operations.”

The CFO, Steve Laxton says they expect record-breaking annual earnings this year for the company!

“For the third quarter, we expect lower earnings from our steel mills segment relative to Q2, and we expect continued strength in steel products and raw materials with performance roughly in line with the second quarter.

For the year, we expect earnings per share will establish a new annual record for Nucor.”-CFO, Steven L.

Looking At The Chart

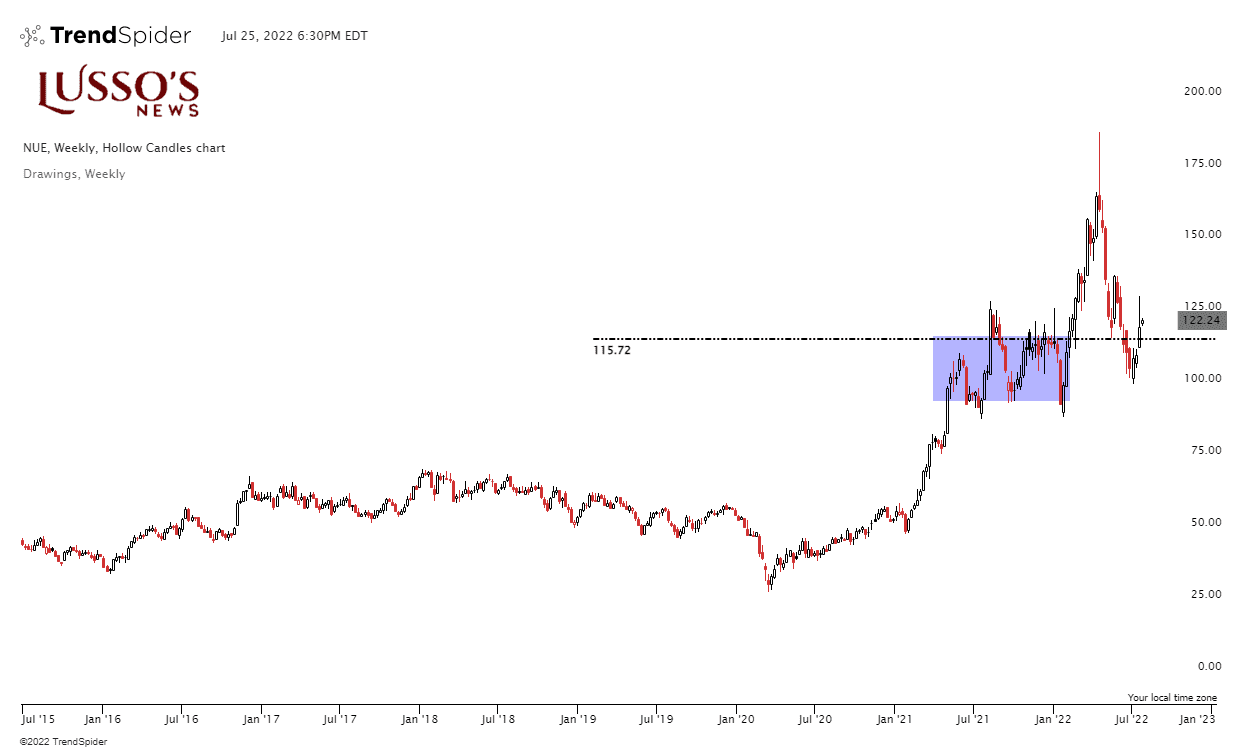

As you can see, NUE is a very similar chart to STLD.

It has pulled back and had a correction to prior resistance which appears to be near support for the time being.

As long as the stock stays over $115 then bulls have a valid technical thesis in play in my opinion.

With many companies reporting uncertain quarters, NUE and STLD are BREAKING RECORDS!

Do record-breaking quarters and optimistic guidance cause confidence for investors? The answer is YES!