12/6: Blockchain Stock Of Interest, S&P 500 Comments + More; Charts INCLUDED

Stocks Of Interest To Us

Traders,

✔Tonight, I am sharing a company that has my attention for numerous reasons which I will explain below.’

✔We discuss the current state of the markets with emphasis on USD and SPY 0.00%↑

✔We discuss NFLX 0.00%↑ and TSLA 0.00%↑ as well.

Enjoy🎊🎉👇

Santo Mining Corp [OTC: $SANP]

One thing of interest of mine has been BITCOIN ATM’s! And no…not just because they look cool.

I really do think there is a bright future for this industry.

I came across Santo Mining Corp [OTC: $SANP] press release from a year ago during my research and saw they had planned to purchase a lot of Bitcoin ATMs.

This caused me to further look into the company and once I dug a little deeper, I saw some stuff I liked. 👇

1️⃣ They have an office with what appears to be multiple employees in Medellin, Colombia.

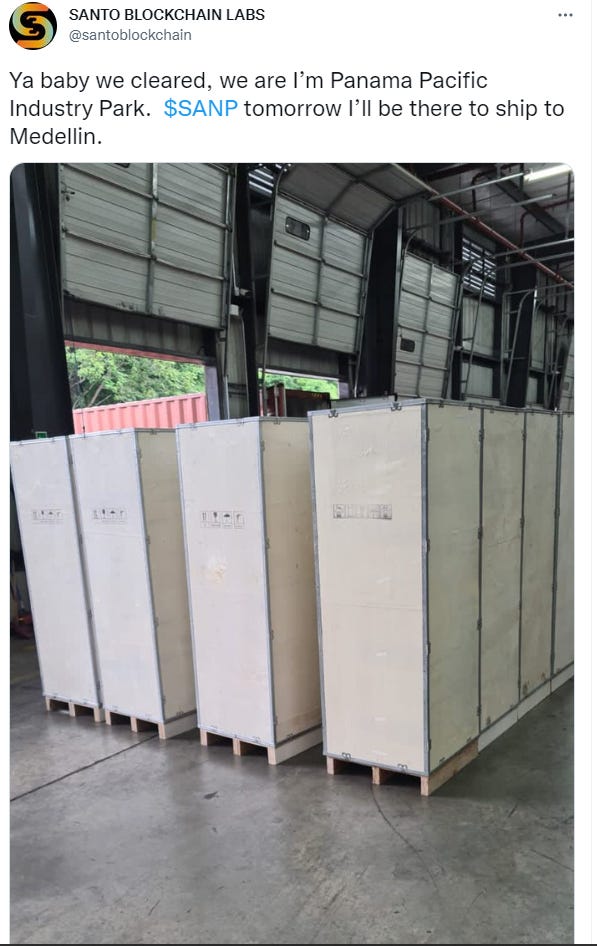

2️⃣They have pictures of ATM’s getting delivered.

3️⃣ Check out what appears to be their office. This is impressive for a company listed on the OTC.

Recently the company has released the following press releases👇

👉Announced a CHANGE in Corporate Strategy

👉Announced Strategic Partnership with 10% Ownership Of XPO.CRYPTO S.A.S

👉SANP Contracted to Develop AGUA Coin (accesswire.com)

The Chart

I do see a bull flag on the weekly chart.

The bull flag could be of interest for momentum traders as you can see this stock has run in the past before with very big volume running

This appears to be their office…

If this is their office, then I am encouraged in what I see.

There are a good amount of desk and people in this office which catches my attention as in terms of the company looking to grow and be productive.

The Bottom Line

The bottom line is this company had noticed the shift in macroeconomics early on and announced a change to their corporate strategy early in 2022 to get ahead of the game.

As you can see from the video via twitter, the company has a hefty amount of employees for marketing, developing and doing things for the ATM stream as well.

S&P 500 Commentary

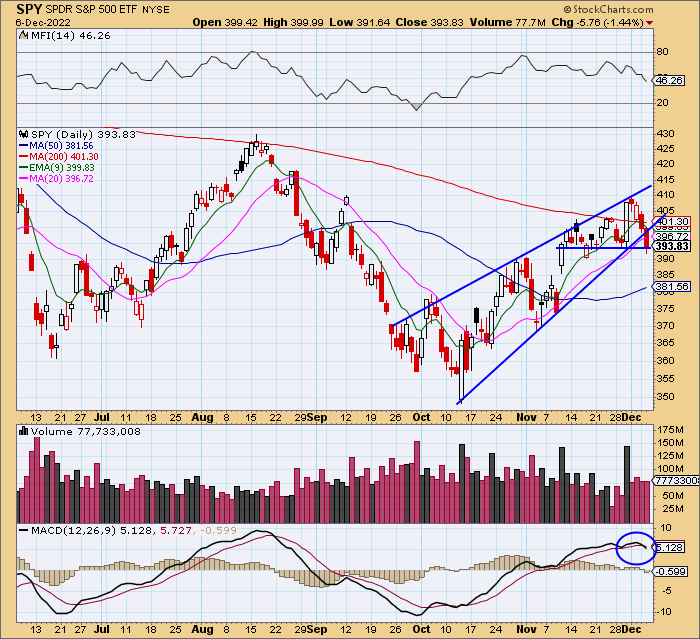

The SPY 0.00%↑ has broken down below a key trendline support line.

This support line has held 5 times until it broke down today!

The BAD NEWS👇

❌Price below 20sma and 9ema which shows the short-term line of least resistance is to the downside.

❌ Price is below $400 and the 200 sma which have both been a significant level for bulls. That level did not hold as support.

The GOOD NEWS👇

✔$393 appears to be a area of prior support and that area has held up today.

💡With the SPY below the 9ema, I will not touch it long unless it is a daytrade. I only trade on the line of least resistance and for my timeframe, it must be on the side of the 9ema.

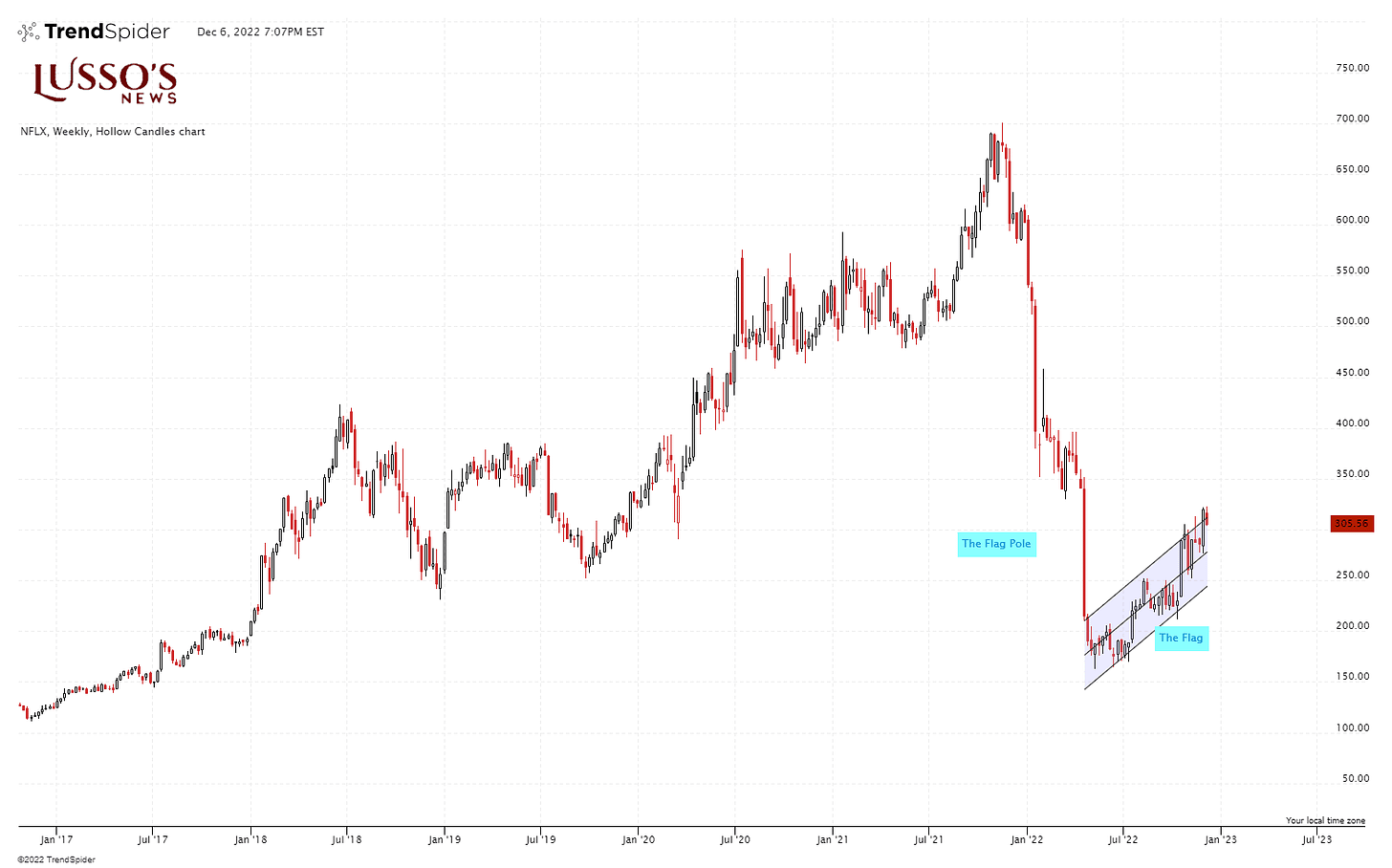

Netflix MASSIVE Weekly Bear Flag NFLX 0.00%↑

Netflix has moved in a consistent uptrend since the summer but, it is at the top of a bear flag resistance line on the weekly chart.

A rule of thumb…weekly chart patterns are stronger than daily chart patterns.

With the SPY 0.00%↑ now below the 9ema it could be of interest to short sellers to turn their attention to NFLX 0.00%↑

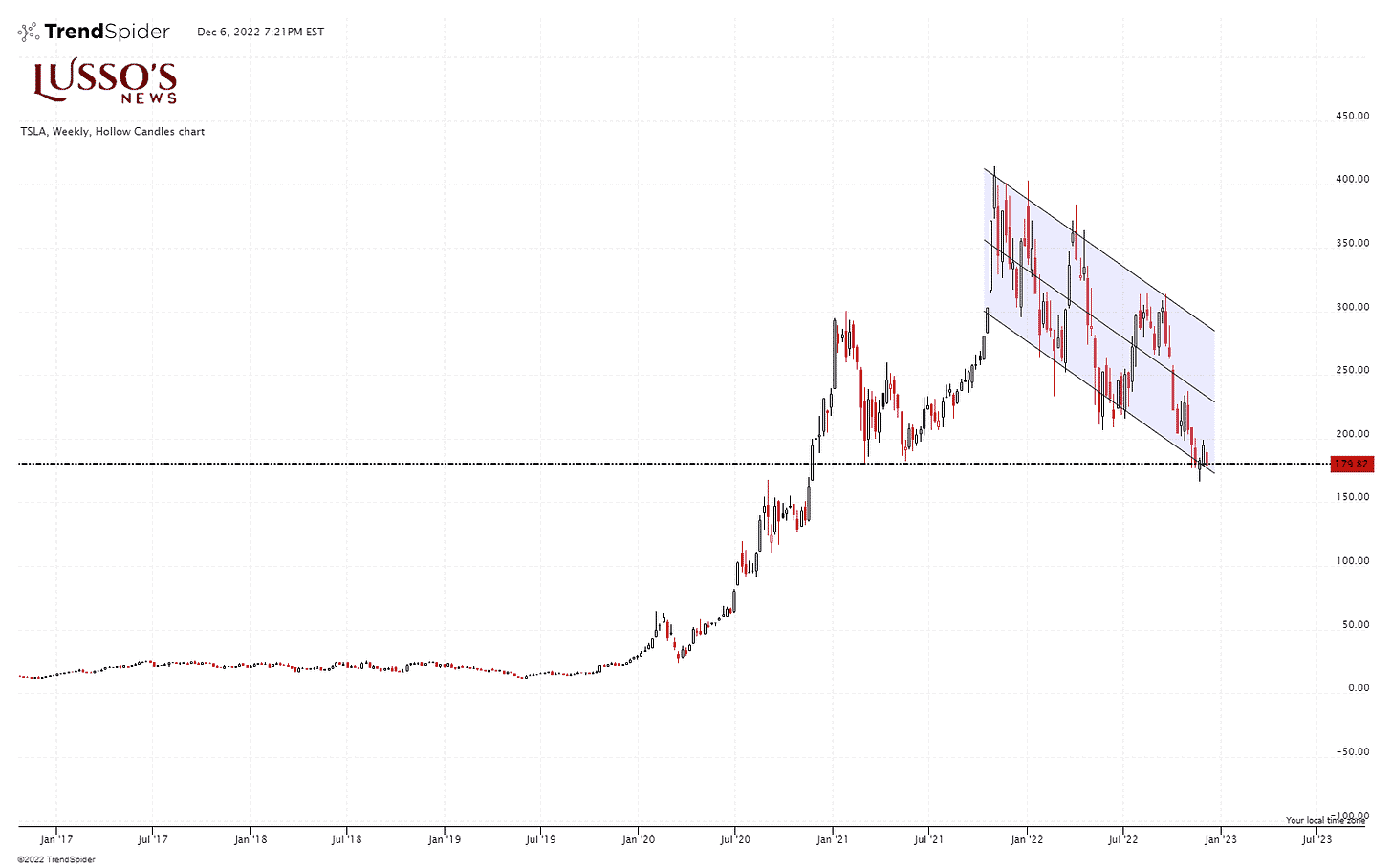

Tesla At Massive Support Area TSLA 0.00%↑

Tesla has been hovering around an area that has been STRONG SUPPORT in the past.

The $180 level is a area that is of interest for bulls and bears because it has acted as support multiple times.

TSLA 0.00%↑ is 👇

✔At the bottom of a Descending Channel Pattern on the weekly chart

✔At/Near $180 support on the weekly chart

💡Trading between $195 and $176 on the daily chart

US Dollar

The US Dollar has seen a RAPID/FIERCE/AGRESSIVE sell off from around $114.

This has helped give a massive spart to stocks as a strong dollar has been bad for stocks. A weak dollar has been good for stocks.

Now, the US Dollar has pulled back to support and has seen 2 days of green and now back above the 200-day moving average.

IF $DXY (USD index reclaims over $107 then it could put massive pressure on stocks in my opinion.

The Bottom Line

The bottom line is blockchain technology is here to stay in my opinion and companies that are unheard of have a chance to gain market share if they capitalize on their strategy.

The USD is gaining strength while stocks are gaining momentum to the downside.

NFLX 0.00%↑ is at resistance and TSLA 0.00%↑ is at a significant level that could lead to a potential breakout breakdown.

It remains a daytrader market unless you want to look longer term or try to nail a multi-day short trade.

DISCLAIMER: Lusso’s News LLC offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at Lusso’s News, LLC on a written article, post, newsletter or comment, you agree to hold Lussosnews.Com liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lossed at any time. Lusso’s News, LLC never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at Lusso’s News, LLC may be buying or selling any stock mentioned at any given time. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Lusso’s News, LLC Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Lusso’s News, LLC recommends you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk-free” industry. If you do agree to this, then please exit our website now. LUSSO’S NEWS, LLC IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, Lusso’s News, LLC nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education. THE ABOVE POWERHOUSE REPORT INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND DISCLAIMER. OUR REPORT IS FOR INFORMATION PURPOSES ONLY AND IS NOT BUY OR SELL INVESTMENT OR TRADE ADVICE. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED AND FULL RISK APPLIES OF LOSING MONEY ON A TRADE. OUR WRITERS AND TRADERS ARE NOT LICENSED OR FINANCIAL ADVISORS.