12/11: These Stocks Have 30% Downside? S&P 500 Deep Dive, USD Comments And More

3000+ Words For The SERIOUS Trader

Welcome to our REPORT!!

We are so excited to be back after taking a week off!

First, I want to start with a brief message👇

When it comes to charting focus on quality only not quantity!

I see 100s of charts each day on the internet being posted but, the reality is that most stocks trade in correlation to the S&P 500 so most of the time it is better to trade the S&P 500!

Question: When is it valid to trade stocks instead of the S&P 500 or NASDAQ 100? SPY -0.45%↓ QQQ -0.31%↓

When the company has solid momentum in their fundamentals.

When the company has strong relative volume that is at least 2-3 times higher than any normal day.

When the chart is REALLY REALLY good.

This is a mistake many traders make, is that they focus on 100+ subpar charts instead of only focusing on 4-6 GREAT charts!

Because like I said, it is better to just trade the SPY -0.45%↓ or QQQ -0.31%↓ instead of a SUBPAR chart.

This is our identity at Lusso’s News Insider via Substack…is to focus on the potential MASSIVE MOVES and not subpar set ups!

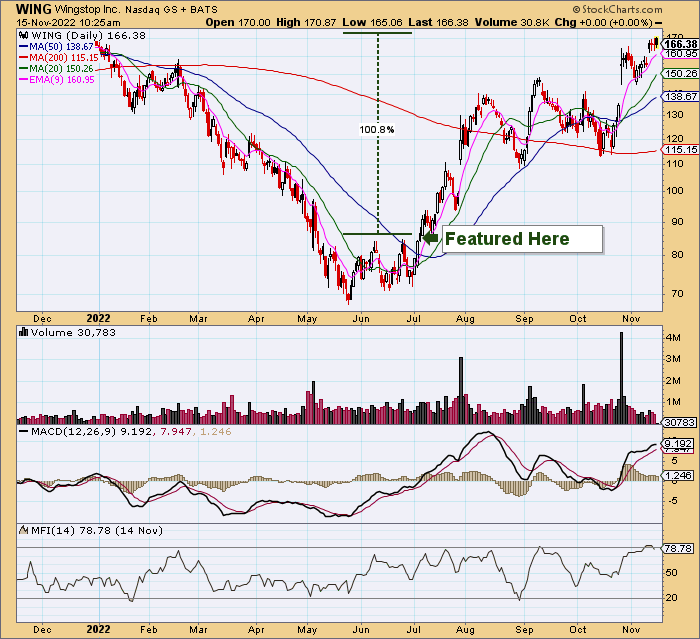

This is why we called WING -0.67%↓ before it ran 100%👇

This is why we called ELF -1.43%↓ before it ran over 40%👇

This is why we called AEHR -5.72%↓ before it ran 100%👇

The bottom line is, focusing on only a handful of great quality names is where the value is for both you and me.

When we focus on a handful of names instead of 100 names, we can reflect on our personal performance our of newsletter to assure our quality and results have been great for our readers!

It is simply not possible to do this if we posted 100 stocks because we cannot reflect on our quality and grade our quality we distribute to our readers!

This is what sets us apart! WE are disciplined about our quality we distribute because our performance and track record matters as we want our readers to gain real value each and every time, they read our report!

Welcome to PART 3 and our full weekend edition report!!

Today I am excited to write about an industry group that we see potentially -30% downside on the charts with a valid fundamental thesis!

I hope you enjoy!

In this report we go over:

A industry group with potential for -30% downside (3 stocks included)

Stocks Under $5 that we like for a short-term trade ( 3 stocks included)

Stock Market Breadth Analysis and Commentary

Technical deep dive in the S&P 500 with a 4-question answered segment

A look at the USD and how it can get us prepared for Wednesdays big FOMC

And a lot more with over 3000 words to help prepare your for the week

We will issue report throughout the week as well!!!